With Sastrify's SaaS spend management solution, your procurement team can obtain the best deals while purchasing and renewing SaaS subscriptions. However, there are certain limitations that the tool poses that hinder the spend management process. So you, as an IT manager, can explore other Sastrify alternatives to make the missing functionalities available.

Sastrify's SaaS spend management solution is a digital procurement platform specifically designed for SaaS products. It offers a variety of features to optimize SaaS spend.

Some of the most used functionalities of Sastrify's SaaS spend management are:

Features Of Sastrify SaaS Spend Management Platform

- With Sastrify, your finance team can connect seamlessly with your ERP or accounting system to gain comprehensive insights into your entire SaaS ecosystem. This visibility helps identify and eliminate duplicate SaaS subscriptions, ensuring optimal resource utilization.

- Sastrify allows your team to set proactive alerts for upcoming renewals, which helps them stay ahead of deadlines.

- Its negotiation experts support your procurement team to secure deals and save on SaaS costs.

- Also, your team can easily share reports and forecast future SaaS spend; this helps your managers do better financial planning.

Even though it offers a variety of benefits, it still falls behind due to its shortcomings, such as

Drawbacks Of Sastrify’s Spend Management Platform

- The initial setup of Sastrify presents a downside, as it requires a significant amount of manual work to input all the necessary information for each tool and to search for contracts and other relevant details. This manual data entry and search process can be time-consuming, delaying the setup process.

- Users have reported occasional errors in the billing functionality of Sastrify, leading to discrepancies in invoicing and financial records, potentially causing confusion, delays, and the need for additional manual intervention to rectify billing discrepancies.

- Another limitation is that its \"spend\" functionality is not fully developed yet. So it's difficult to find out how much money is spent. Due to the lack of accuracy, relying on Sastrify's spend tracking is not considered for making informed financial decisions.

While sticking to a single tool is not mandatory, exploring alternative options can provide access to a broader range of features that align more closely with your organization's spend management requirements. Therefore, this blog will present a curated list of Sastrify competitors that offer better functionality than Sastrify.

Here’s A List of 7 Best Sastrify Alternatives & Competitors

Below are the alternatives to Sastrify that you, as an IT manager, can consider opting to optimize your organization's SaaS spend.

1. Zluri

Zluri is an advanced SaaS management platform that helps your finance team efficiently manage SaaS spend. Also, it assists your procurement team in acquiring software at the best deal. How does it do that? Zluri's SMP offers exceptional features such as license management, renewal management, and SaaS procurement capabilities. With the help of these features, your teams can effectively minimize SaaS expenses and optimize your SaaS stack and other existing resources.

This was just a glimpse of what Zluri is capable of. Let's explore each capability contributing to effective spend management for a more in-depth understanding.

- Offers SaaS Buying Capabilities To Help Acquire Software At the Best Price

Zluri offers excellent SaaS buying capabilities, making purchasing SaaS apps less complicated. Zluri allocates experts who help your procurement team by negotiating the best prices and deals tailored to your application requirements. They use two effective negotiation strategies: ZOPA (Zones of Possible Agreements) and BATNA (Best Alternative To a Negotiated Agreement).

- Zones of Possible Agreements Example

Let's suppose you have a $20,000 budget for a SaaS app and discover vendors offering the required app within the price range of $15,000 to $25,000 through market research. The ZOPA represents the overlapping range between your spending limit and the vendor's price range ($15,000 to $25,000). Zluri leverages this information to negotiate confidently, aiming to secure a price closer to $15,000 while ensuring the vendor remains profitable.

- Best Alternative To a Negotiated Agreement Example

In another scenario, let's assume you are negotiating a new service agreement with a preferred vendor who charges $10,000 per year. However, you have received estimates from other vendors offering the same service for $7,000 and $5,000 annually. In this situation, your best alternative is to consider one of the other vendors if the preferred vendor's price exceeds your budget.

With this knowledge, Zluri negotiates with your preferred vendor to secure a price closer to $7,000 or $5,000 annually, based on your BATNA. Alternatively, Zluri helps you leverage your BATNA and select a different vendor if the preferred vendor cannot match this price.

Furthermore, Zluri's dedicated experts collaborate with your team to ensure that you only pay for the essential features of the applications, preventing unnecessary spending. They also ensure that deployed applications comply with company standards, thus avoiding hefty penalties.

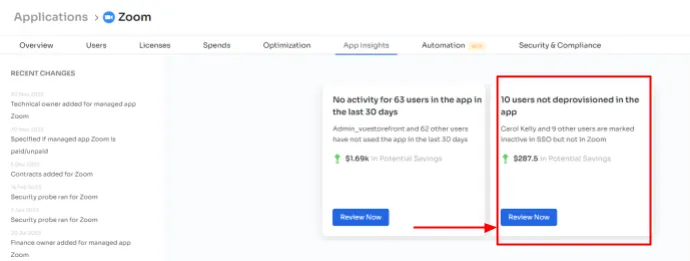

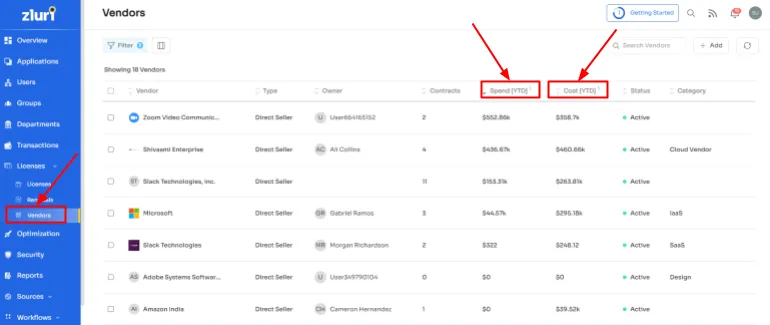

- Helps Your Team Identify Key Areas Of Expenditure

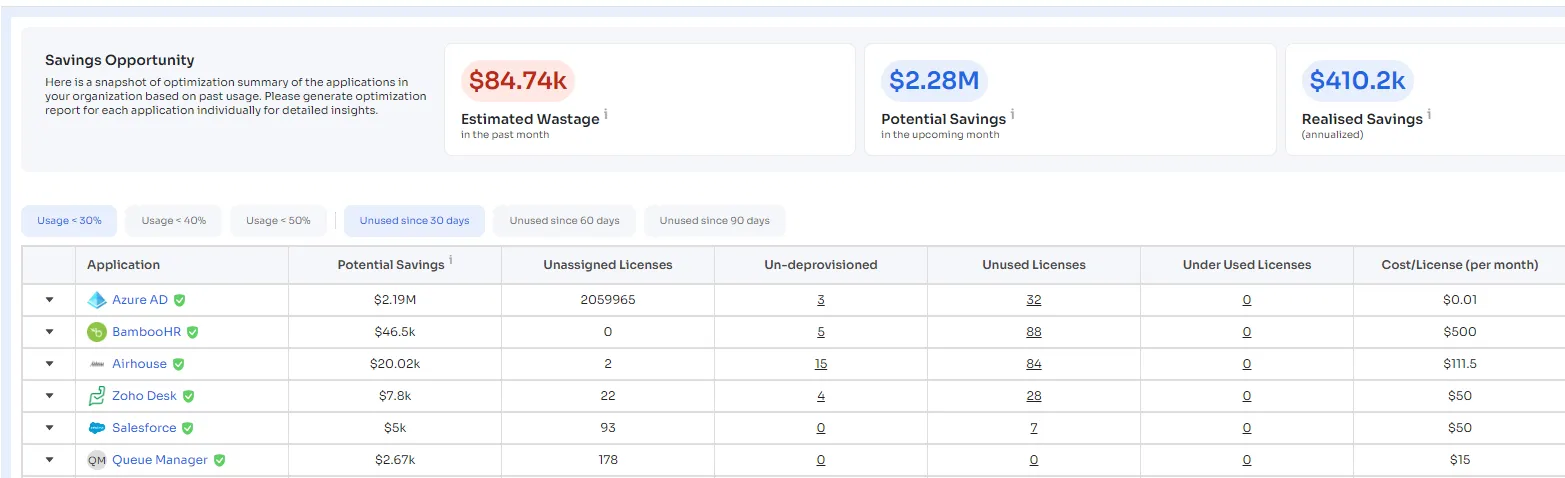

If your organization has a huge SaaS stack and it's difficult to find which applications add value and which are redundant, Zluri's SMP has you all covered. It gives you a 360-degree view of all SaaS expenses.

For example, how much budget is allocated to each department for their operations, what is estimated spend vs. actual spend, which cards are used for making payments- personal or corporate cards, and more. Getting such minute insights surely helps you optimize your overall SaaS spend.

But how does Zluri do all this? It offers you five discovery methods, i.e., SSO or IDP, finance & expense management, direct integrations, browser extensions (optional), and desktop agents (optional). This allows you to discover all the SaaS applications present in your organization.

Furthermore, with Zluri's SMP, your team can acquire all the app details that help analyze which app offers similar functionalities. Accordingly, your finance team can discontinue the subscriptions for duplicate and redundant SaaS apps, cutting down on SaaS costs.

- Effectively Manages Licenses To Save on SaaS Cost

Further, it helps your finance team right-size licenses to suitable tiers. For example, if you currently use only limited features of an application but pay for its premium version, Zluri'SMP examines the usage patterns and identifies the most utilized features. With this information, you can easily shift to a lower-cost tier that provides the necessary features, eliminating wasteful spending on unused functionalities.

- Conducts Periodic Audits And Generates Curated Reports

Zluri doesn't stop here; it conducts periodic audits and generates detailed usage reports for applications, providing real-time insights on active user logins and logouts. These reports become invaluable tools during renewal discussions, empowering you to make informed decisions regarding which applications to continue with and which to suspend or reallocate.

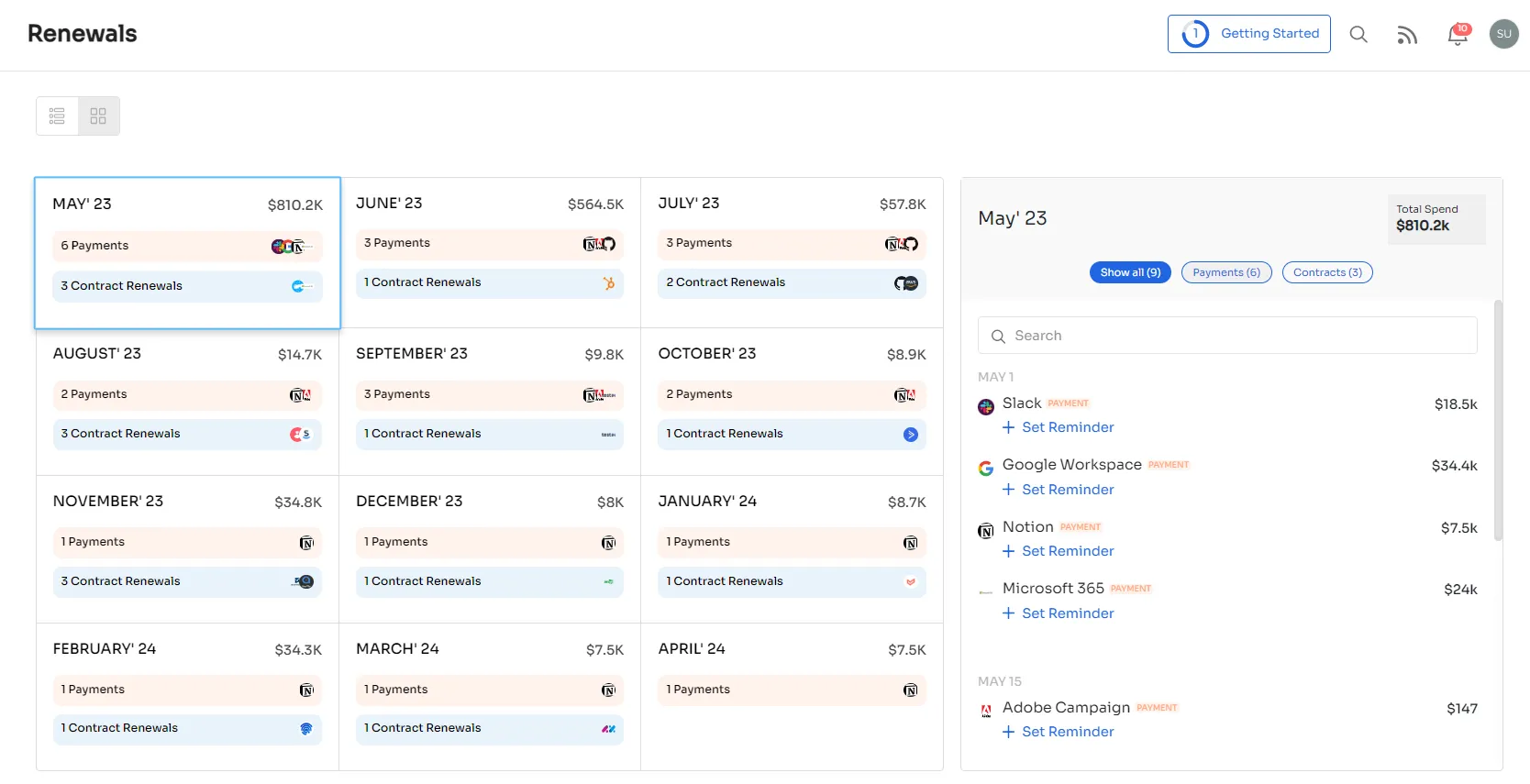

- Seamlessly Manages SaaS Renewals To Prevent Unnecessary Expenses

Additionally, you can get updates on upcoming renewals with the help of a renewal calendar. Before proceeding with the payment, you can make decisions to continue with the subscriptions and contracts or cancel them by identifying the app usage per user.

You can prioritize the renewals as required and manually set alerts at your convenience. By default, you will get alerts for contracts 30, 15, 7, and 1 days prior to renewal, and for payments, you get 7 and 1 days prior to renewal.

So what are you waiting for? Book a demo now and see how it helps your IT teams streamline the SaaS spend management process.

Pros

- Zluri simplifies license management by helping your finance team track, reallocate, and reclaim licenses upon an employee's departure, saving on SaaS costs

- It helps identify hidden charges associated with true cost by providing your finance team with cost and actual spend (YTD) data. This enables them to figure out the differences and obtain accurate expense information precisely

Cons

- To generate accurate spend-related reports, you have to input spend data manually into the system, which can be quite challenging while dealing with large datasets

- Sometimes, integrating with other tools to acquire more usage insights can be a little difficult and may require attention to detail to ensure they work properly

Customer Rating

- G2: 4.8/5

- Capterra: 4.9/5

2. Torii

Torii's SaaS spend management center being one of the notable Sastrify alternatives connects various sources like ERP (enterprise resource planning) and effortlessly discovers SaaS license spend and shadow IT. This allows your team to manage area expenses effectively.

Furthermore, your finance team can measure app ROI by combining license cost data with user adoption data. Your team can maximize ROI and optimize SaaS spend by gaining this valuable insight.

This Sastrify alternative integrates with HRIS, allowing your finance team to analyze and track SaaS spend by software category, business unit, application owner, or any other parameters. This further allows your managers to make informed SaaS spend decisions faster.

Pros

- Torii's SaaS spend management center enables your team to swiftly trace and manage departed employees' licenses, which further helps your finance team to reclaim or reallocate those licenses, saving on SaaS cost

- It sends alerts on expiring contracts or unused subscriptions. With timely notifications, your manager can make informed decisions before the renewal deadline, such as which subscription to continue with and which not to. This further allows your finance team to optimize the SaaS spend. Also, by doing so, your team can ensure that you only pay for what you need

- It sends real-time alerts for expiring contracts or unused subscriptions, enabling your managers to make informed decisions before renewal deadlines. This further helps your finance team optimize SaaS spend, ensuring they pay only for what is required

Cons

- At times, it's difficult to differentiate between critical applications and non-essential free tools that may clutter the data. With abundant identified applications, it can be a challenge to prioritize and track the ones that are essential for your business operations. Also, this can potentially lead to the leakage of SaaS costs by paying for duplicate and redundant apps

- There are instances where the automated processes do not run smoothly, requiring manual intervention. This dependency on manual execution can be inconvenient and may disrupt workflow efficiency. Further, the resources and money invested in running the process also go to waste

- Absence of certain key features, such as the ability to generate a report of the expenses made within the platform. This limitation is particularly concerning, considering that expense management is a core aspect of Torii's business. Without this feature, users are unable to easily access and analyze their spending data, which can be crucial for budgeting, financial analysis, and decision-making

Customer Rating

- G2: 4.5/5

- Capterra: 5/5

3. Vendr

Vendr's SaaS spend management, one of the notable Sastrify alternatives provides your finance team with complete visibility into your company's tech stack and allows them to become proactive with SaaS spend. This further helps your team to get control over every purchase while ensuring contracts are compliant and obtaining the best deals on SaaS app purchases.

Also, your finance team can see the end-to-end SaaS purchasing lifecycle in a single platform, from requests to workflows to annual maintenance. This allows your finance team to be in the loop on every dollar spent.

Furthermore, with this Sastrify alternative, your procurement team doesn't have to waste hours on research and obtain a fair price. Also, it assigns experts who understand the ins and outs of buying SaaS apps.

Pros

- Vendr's SaaS spend management ensures your finance team is getting the most out of your SaaS stack by providing you with a holistic view of SaaS spend across your organization, all in one place. This insight will help your finance team optimize SaaS spend and maximize return on investment

- It gives your procurement team insights into fair market value for SaaS, eliminating pricing uncertainty while purchasing. Further, the vendr's negotiation expertise on behalf of your team secures the best possible pricing. With Vendr's assistance, your team can confidently navigate SaaS purchasing with a clear understanding of fair pricing benchmarks, optimizing our procurement strategy and maximizing cost savings.

Cons

- Vendr's SaaS spend management lacks effective reporting functionalities, which challenges the finance team while extracting insights accurately on SaaS expenses. This ultimately hinders the ability to manage and analyze SaaS expenses efficiently effectively

- It is unable to identify overlapping SaaS spend for similar applications. While it can detect multiple instances of the same SaaS app, it falls short in providing competitive data and a comprehensive view of similar apps in a single dashboard. So, you may end up paying for duplicate apps

Customer Rating

- G2: 4.6/5

4. Airbase

Airbase, one of the notable Sastrify alternatives automates business expense management, offering consistent workflows for all spend. With the help of this tool, your employees can quickly submit expense details and get reimbursed accordingly. This way, it becomes easier for your finance team to keep track of each expense made by the employees, reducing the chances of mismanagement of the SaaS budget.

Furthermore, this Sastrify alternative's automated approval workflows ensure compliance with your organization's policies. For instance, if an employee submits an out-of-policy request, they are blocked or flagged, giving instant clarity so your team can make required changes to their request. By doing so, you can avoid paying hefty penalties for not meeting the compliance regulations.

Pros

- Airbase provides comprehensive expense tracking features that precisely detect and categorize all your SaaS expenses, streamlining the process of monitoring your overall spending

- It seamlessly integrates with multiple payment methods, such as PayPal and credit cards, offering your IT team and employees the convenience of easily making payments for regular IT operations. With Airbase, there's no longer a need to switch between different screens to manage your finances. Furthermore, your finance team can effortlessly track and keep tabs on all your purchases

Cons

- The analytic feature of Airbase lacks efficiency as it struggles to analyze categories with high spending, making it difficult to accurately determine the exact amount spent in each category.

- The tool takes time to reflect payments, particularly when using a corporate credit card. It may take up to 1 business day for the payment to appear. This delay can pose challenges for the finance team when preparing expense reports, as it doesn't accurately display the purchase date

Customer Rating

- G2: 4.8/5

- Capterra: 5/5

5. Zylo

Zylo's SaaS spend management solution provides a comprehensive and in-depth view of a company's technology investments, encompassing both employee-owned and purchased software. It plays a crucial role in preventing unnecessary expenses and helps you make smarter decisions when it comes to SaaS purchases.

Moreover, this notable Sastrify alternative helps your IT team effectively manage software licenses and ensure compliance, enabling your finance team to reduce costs associated with over-licensing. Additionally, the platform serves as a centralized repository for software contracts, simplifying the monitoring of essential details such as renewal dates and associated expenses.

Pros

- Zylo's SaaS spend management seamlessly integrates with various applications like Okta and AzureAD, enabling valuable data extraction on app usage. With the help of this data, your IT team can identify non-essential applications. Further, they can also suspend those apps, which will help in effectively reducing your SaaS spend

- By conducting regular audits, Zylo's SaaS spend management generates curated reports on the SaaS licenses used in your organization. By obtaining this information, your finance team can optimize license allocation and right-size them to appropriate tiers, eliminating unnecessary expenses

Cons

- Zylo's SaaS spend management cannot identify license costs per department, which poses a challenge for the finance team in finding which departments have incurred the highest expenses on licenses

Customer Rating

- G2: 4.7/5

- Capterra: 4.5/5

6. Productiv

Productiv's SaaS spend management offers your finance team a complete view of SaaS spend, enabling them to better understand the cost, usage, and value of their technology investments. This further allows them to optimize SaaS spend more efficiently and minimize SaaS cost wastage.

By tracking the usage of various software and technology assets, Productiv provides data-driven insights into effectively utilizing these assets, helping identify areas where improvements can be made.

Additionally, this noteworthy Sastrify alternative provides automated recommendations and insights to assist your finance team in optimizing technology spend, avoiding license wastage, and mitigating costly true-ups.

Pros

- Productiv's SaaS spend management offers the capability to track crucial application metrics, ownership details, and security information, empowering you to make well-informed decisions regarding the continuity of each application. By leveraging this data, your finance team can assess the value and cost-effectiveness of each application, ultimately reducing overall SaaS expenses

- It offers recommendations to help your finance team right-size to suitable tiers. This ensures that you only pay for the features and functionality that you actually require, eliminating unnecessary expenses and optimizing your SaaS spend

Cons

- It sometimes fails to discover unknown applications, resulting in related expenses not being captured in the system. This limitation necessitates manual checking of spreadsheets and spend statements to identify unknown app data, which can be time-consuming and reduce overall productivity

Customer Rating

- G2: 4.7/5

- Capterra: 4.6/5

7. Spendflo

Spendflo being one of the notable Sastrify alternatives provides a centralized platform for processing invoices, purchase order management, expense tracking, and supplier management. This Sastrify alternative enables your finance team to maintain financial control and minimize the risk of fraud or mismanagement of the SaaS budget.

Moreover, Spendflo offers a robust reporting and analytics engine, allowing your finance team to gain valuable insights into spending patterns and identify opportunities for cost savings.

Additionally, the platform equips your IT managers with the necessary information to make informed decisions regarding procurement and expense management processes. By leveraging Spendflo, your finance team can effectively reduce costs, enhance efficiency, and maximize their return on investment.

Pros

- Spendflo effectively segregates applications based on departments or teams, easily identifying the departments or teams with the highest spending on applications. This feature facilitates better cost management and allows organizations to optimize their application expenses accordingly

- With Spendflo, your finance receives timely notifications about upcoming renewals, ensuring they never miss renewal dates. This proactive feature empowers you to make informed decisions in advance regarding which licenses to retain and which ones to terminate, streamlining your license management process and avoiding any unnecessary expenses

Cons

- Spendflo cannot view alternative apps within the organization's SaaS stack. This can result in employees making unnecessary purchases to access certain functionalities that may already be available through existing applications

- At times, it is unable to complete transactions within specified timelines. This can cause delays and disrupt workflow management, potentially impacting the overall effectiveness of financial operations

- Its reporting capabilities are inefficient, which can pose challenges in accurately identifying the number of app users. As a result, tracking the actual need for licenses and identifying redundant ones becomes difficult. This limitation can hinder optimal license management and may lead to inefficiencies in resource allocation

Customer Rating

- G2: 4.7/5

Manage Uncontrolled SaaS Expenses With The Best Spend Management Solution

Take charge of your unmanaged SaaS expenses by selecting the optimal solution from the provided list. Ensure that the chosen solution aligns seamlessly with your organization's spending requirements. This decision is crucial for streamlining your financial oversight and achieving unparalleled control over your software expenditures. Choosing the right solution can enhance cost efficiency and optimize resources effectively.

FAQs

What Is SaaS Management Software?

SaaS spend management software is designed to manage SaaS procurement, subscriptions, licenses, and associated costs. Through monitoring and analytics, this software identifies user usage and app insights that help in effectively utilizing SaaS tools and enable you to make cost-effective decisions.

What Is The Difference Between Spend Management And Expense Management?

Spend management covers all aspects of procurement and purchasing in an organization. It helps manage the entire procurement lifecycle, from sourcing to payment. On the other hand, expense management specifically centers around employee expenditures commonly associated with travel, entertainment, and other business-related activities.

.svg)