SaaS has become the cornerstone of operational efficiency and productivity for countless organizations. The allure of cloud-based solutions is undeniable, offering the promise of streamlined processes and enhanced capabilities.

However, amid this transformative wave, there exists a critical concern that demands the attention of finance managers, i.e., SaaS spend optimization.

Without vigilant and strategic oversight, SaaS spend can easily spiral out of control, leading to potentially adverse consequences for your organization's financial health. The pivotal question that finance managers must address is this: Why is it imperative to optimize your SaaS spend?

Optimizing SaaS spend transcends the mere act of cost-cutting; it is a strategic imperative to ensure that your organization's investments in these tools yield the highest possible value. This value encompasses both cost-efficiency and maximizing the benefits and advantages that SaaS solutions can bring to your organization.

What is SaaS Spend Optimization?

SaaS spend optimization is a multifaceted approach to financial management within an organization that revolves around making the most efficient use of resources allocated to SaaS applications and licenses.

Its fundamental goal is to harmonize these resources with the organization's real needs and usage patterns. This process involves a series of strategic actions and best practices that collectively contribute to better financial decision-making in the organizational SaaS infrastructure.

SaaS spend optimization ensures your organization's investment in SaaS software is justified and optimized. It entails a comprehensive analysis of the existing SaaS ecosystem, identifying redundancies or underutilized licenses and implementing cost-effective measures to rectify these issues.

Let’s take a look at the key components of SaaS spend optimization:

- Application Rationalization: The process begins with thoroughly assessing all existing SaaS solutions. This step aims to identify redundant or overlapping applications that may have similar functionalities, leading to unnecessary costs.

- License Right-Sizing: By closely examining user licenses, finance managers can ensure that their organization isn't paying for more licenses than required. Right-sizing licenses can significantly reduce expenditure while maintaining operational efficiency.

- Contract Management: Effective management of SaaS contracts is crucial. This includes tracking contract renewal dates, negotiating favorable terms, and eliminating unused or unnecessary subscriptions.

- Usage Monitoring: Implementing tools and processes to monitor SaaS application usage is essential. Identifying under-utilized applications allows for informed decisions on whether to continue, modify, or terminate subscriptions.

- Cost Transparency: Finance managers should establish clear visibility into SaaS costs and allocations across departments or teams. This transparency aids in cost allocation and data-driven IT budgeting.

Benefits of SaaS Spend Optimization

SaaS spend optimization is a critical aspect of financial management for finance managers, offering a range of tangible benefits that directly impact an organization's bottom line.

- Cost and Time Efficiency: Finance managers can reduce unnecessary SaaS expenditures, resulting in substantial cost savings. Financial resources are allocated more efficiently by identifying underutilized licenses and eliminating redundant subscriptions.

Time savings come from streamlined procurement processes and reduced administrative tasks for managing multiple SaaS vendors and licenses. Finance managers can redirect their efforts toward strategic financial planning and analysis. - Enhanced ROI and Budget Management: Through SaaS spend optimization, finance managers can ensure that every dollar spent on SaaS subscriptions delivers maximum value.

You and your teams can achieve a higher return on investment by aligning software resources with actual needs and usage patterns. Mastering budget management becomes more precise, allowing you to allocate resources strategically.

This ensures funds are directed toward SaaS tools that drive productivity and support the organization's goals, optimizing the budgetary impact. - Clean Stack and Resource Allocation: You and your teams can maintain a clean and efficient SaaS stack by eliminating redundant or outdated applications. This simplifies the IT landscape, making managing and reducing licensing and maintenance costs easier.

Resource allocation becomes more strategic and agile. You can reallocate budgetary resources based on changing organizational needs, ensuring that SaaS tools are deployed where they have the most significant impact. - Improved Compliance: Ensuring your organization complies with SaaS licensing agreements is crucial. Failure to do so can result in legal and financial risks.

SaaS spend optimization enables you to maintain compliance by tracking and managing licenses effectively, reducing the chances of costly legal disputes or penalties.

Best Practices to Optimize Your SaaS Spend

Efficient SaaS spend management is critical for you and your teams seeking to align software investments with organizational objectives. To achieve this, consider the following best practices:

- Continuous Monitoring and Adjustments

Maintaining a vigilant eye on your software landscape is essential. Regular assessments of your software portfolio and usage patterns are vital.

This ongoing process helps identify opportunities to optimize costs, such as spotting underutilized licenses or redundant applications. You can make informed decisions about software investments by staying adaptable and responsive to your organization's evolving needs.

These decisions, informed by regular reviews, ensure that your organization neither overspends nor misses out on potential savings, resulting in a streamlined and cost-effective software ecosystem.

- Cross-functional Collaboration

Effective SaaS spend optimization requires collaboration across different departments. Encouraging seamless communication and cooperation between finance, IT, and other relevant stakeholders is key.

This collaborative effort ensures that software investments align not only with budgetary constraints but also with operational requirements. Involving all pertinent parties in decision-making processes allows for a comprehensive evaluation of software applications.

Through this collaborative approach, you can identify essential applications and determine opportunities for consolidation or elimination, leading to optimized operations and reduced expenses..

- Data Security & Compliance Considerations

As a finance manager, you're also responsible for safeguarding your organization's data and ensuring regulatory compliance.

When selecting and managing SaaS solutions, it's imperative to prioritize data security and compliance. Choose vendors who have robust data governance frameworks in place. Overlooking these aspects can result in severe legal and financial consequences.

Therefore, integrating stringent security and compliance considerations into your SaaS spend optimization strategy is not just essential but foundational to maintaining the integrity of your organization's data and operations.

By following these best practices, you can effectively manage SaaS spend while safeguarding your organization's financial health and operational efficiency.

Top 4 Strategies for SaaS Spend Optimization

Finance managers ensure that every dollar spent on SaaS aligns with organizational objectives and budgets. To excel in this role, consider implementing the following strategies tailored specifically to you and your teams:

1. Vendor selection & negotiation

Imagine as a finance manager for a growing e-commerce company. Your team has adopted a new customer relationship management (CRM) SaaS platform to improve customer support. Before you jump in, you carefully evaluate multiple CRM providers. You opt for a vendor that offers the necessary CRM features and allows you to negotiate favorable pricing based on your expected user growth.

The choice of vendors can significantly impact your organization's financial health. Thoroughly examine SaaS providers to choose those that best match your organization's unique requirements and long-term objectives. Prioritize vendors that offer the essential features and services your business relies on.

Moreover, the art of negotiation plays a crucial role in SaaS spend optimization. Leverage your negotiation skills to secure favorable pricing and contract terms. Explore options like volume discounts, flexible payment arrangements, and beneficial cancellation policies to get the most value for your budget.

2. Right-sizing SaaS subscriptions

Another key strategy is ensuring that your SaaS subscriptions align with your usage. Continuously evaluate and analyze the real usage of SaaS subscriptions across your organization. Identify licenses or features that are overused or underutilized.

Scalability is also essential. Ensure that your subscriptions can adapt to your evolving business needs. Avoid unnecessary costs associated with over-provisioning or underutilization by selecting scalable options that grow with your organization.

Let’s say you manage finances for a software development firm. You notice that your team is paying for a premium subscription to a design tool that only a few designers use. By analyzing usage data, you identify this discrepancy and switch those users to a more cost-effective plan, resulting in significant monthly savings without compromising productivity.

3. Implementing cost control policies

To maintain cost discipline across your organization, develop clear, comprehensive policies for SaaS acquisition, usage, and decommissioning. These policies should define approval processes, spending limits, and compliance requirements.

Equally important is their enforcement. Actively enforce these policies to ensure compliance and maintain fiscal discipline. Regularly review and update them to stay in sync with changing business demands and industry trends.

Suppose you're the finance manager for a mid-sized law firm. You establish clear policies for SaaS acquisition and usage to maintain cost discipline. You implement an approval process for new software purchases, ensuring each request aligns with the firm's legal practice areas. This prevents unnecessary spending on software that doesn't directly contribute to client service.

4. Real-time expense tracking & reporting

Investing in the right tools is key to effective SaaS spend optimization. Look for robust expense-tracking tools and reporting systems that offer real-time visibility into your SaaS spend. These tools should provide detailed insights into spend patterns, usage trends, and opportunities for cost savings.

With access to real-time data, finance managers can proactively oversee SaaS expenses. This empowers you to make informed decisions promptly, such as adjusting your SaaS portfolio based on actual usage.

As the finance manager of a retail chain, you invest in a comprehensive expense tracking system. This system helps you monitor your SaaS expenses in real-time and generates detailed reports.

By closely tracking usage and costs, you identify that a marketing automation tool, initially considered essential, is significantly underutilized. You promptly adjust the subscription, resulting in substantial annual savings.

By implementing these 4 SaaS spend optimization strategies, you and your teams can be pivotal in optimizing SaaS spend within your organization. These actions result in cost savings and foster a more agile and fiscally responsible approach to SaaS management. Ultimately, aligning financial goals with business objectives enhances the overall financial health of your organization.

Balancing the need for essential software with budget constraints and ensuring efficient utilization of resources can be daunting. However, a solution can greatly assist you in this endeavor: Zluri, an intelligent SaaS Management Platform (SMP). Let’s explore how Zluri can help you optimize your organization's SaaS spend effectively.

How Zluri Helps With SaaS Spend Optimization

Zluri offers a robust set of features and capabilities that can help optimize your organization's SaaS spend effectively. Here's how Zluri achieves this and why it's valuable for finance managers:

Identifying Hidden Spend

Zluri plays a crucial role in helping you identify hidden spend within their organization. Here's how Zluri accomplishes this task effectively:

- Centralized Dashboard: Zluri centralizes all this data on a user-friendly dashboard, making it easy for finance managers to access and analyze critical information. The dashboard offers a clear overview of SaaS expenditures, license utilization, and cost differentials, enabling finance managers to make data-driven decisions.

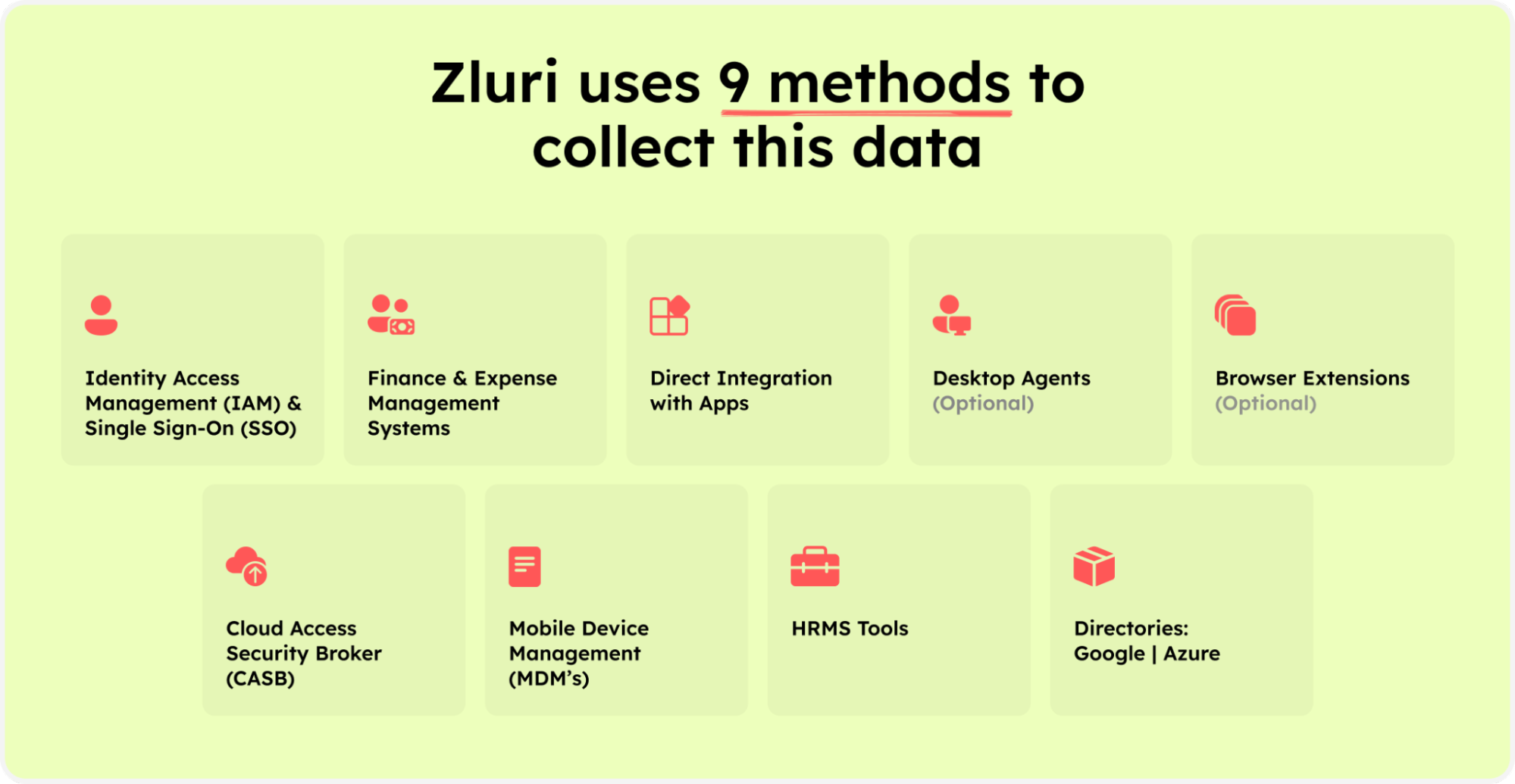

- Comprehensive SaaS Discovery: Zluri employs nine discovery methods to identify all the SaaS applications within your organization. These methods include MDMs, IDPs & SSO, direct integration with apps, finance & expense management systems, CASBs, HRMS, directories, desktop agents (optional), and browser extension (optional). This comprehensive approach ensures that no SaaS app goes unnoticed.

- Zluri’s nine discovery methods

- Eliminating Shadow IT: By discovering all SaaS applications in your organization, Zluri helps eliminate shadow IT. This is critical because hidden or unauthorized software subscriptions are often a significant source of hidden spending. Finance managers can gain visibility into these subscriptions with Zluri.

- Identifying Duplicate and Redundant Apps: Zluri provides detailed information about each application in your SaaS stack. Finance managers can use this data to identify applications that offer similar features. By pinpointing duplicates and redundancies, your finance team can make informed decisions about discontinuing subscriptions, thus reducing unnecessary SaaS costs.

- Managing License Utilization: Zluri goes beyond discovering applications by tracking license utilization. It identifies underutilized and unused licenses across different departments. This information empowers finance managers to optimize license allocation. For example, if certain departments have unused licenses, they can be reallocated to other areas where there is greater demand, effectively reducing expenditure on unnecessary licenses.

- Cost and Spend Analysis: Zluri provides your finance team with detailed cost and actual spending data, allowing for year-to-date (YTD) expense tracking. By comparing the expected costs with actual spending, finance managers can pinpoint discrepancies and uncover hidden charges.

- This information is invaluable for maintaining accurate financial records and optimizing budget allocation.

Monitoring SaaS Renewals

One of its key features of Zluri is the Renewal Calendar, which serves as a pivotal asset for you and your teams.

- Monitoring Upcoming Renewals:

With Zluri's Renewal Calendar, your finance team gains real-time visibility into all upcoming SaaS subscription renewals. This proactive approach empowers finance managers to make well-informed decisions regarding whether to continue or cancel subscriptions and contracts.

This is accomplished by assessing the usage of various applications leading up to the renewal deadline.

- Month-wise Payments and Contracts:

Zluri simplifies financial management by presenting all payments and contracts in a month-wise view within the Renewal Calendar. This organized overview allows finance managers to plan and allocate resources effectively, ensuring that renewals align with budgetary goals.

- Flexible Prioritization:

Zluri understands that not all renewals are created equal. Finance managers have the flexibility to prioritize renewals based on specific requirements. For instance, if a renewal involves a substantial financial commitment, it can be elevated in priority within the platform. This ensures that critical renewals are addressed promptly and efficiently.

- Customizable Alerts & Automated Alerts:

Zluri empowers finance managers by allowing them to set manual alerts at their convenience. This feature ensures that they stay updated on essential renewal deadlines, giving them the autonomy to manage their workload effectively.

By default, Zluri's renewal management system provides automated alerts to your finance team at critical junctures. For contracts, timely alerts are issued 30, 15, 7, and 1 day before renewal, while for payments, alerts are sent 7 and 1 day prior to renewal. This comprehensive alert system guarantees that finance managers remain in complete control and have a clear overview of the renewal processes.

Understanding Software Usage

Zluri can greatly assist you and your teams in understanding and optimizing software usage within their organization. Here's how Zluri can help:

- Identifying Active vs. Inactive Usage: Zluri provides valuable insights into software usage patterns, allowing finance managers to distinguish between active and inactive users. This means you can see which employees are actively utilizing specific software features and which ones are not.

- Optimizing Subscription Tiers: With the information Zluri provides, finance managers can make informed decisions about subscription tiers. For instance, if an employee is paying for a premium version of a software tool but only uses basic features, Zluri will highlight this. Finance managers can then adjust subscriptions to ensure they are paying only for what is actively being used, thus reducing unnecessary expenses.

- Resource Allocation: Zluri helps finance managers optimize resource allocation by ensuring that software costs are aligned with actual usage. This avoids the common problem of paying for unused features or subscriptions.

- Multi-year Negotiations: For frequently used and critical applications, finance managers can leverage Zluri's insights to negotiate multi-year deals with vendors. This strategy can result in long-term cost savings.

- Finding Suitable Substitutes: Zluri also assists in finding suitable substitutes for applications that employees don't use but are essential for their roles. This helps avoid unnecessary expenses while still providing employees with the necessary tools.

- Discontinuing Unused Apps: Applications that neither employees use nor are critical to their job functions can be discontinued, eliminating unnecessary costs associated with unused software licenses.

- Department-Wise App Usage Tracking: Zluri offers a centralized dashboard that provides detailed information on department-wise app usage. This allows finance managers to track how each department is utilizing software licenses, the percentage of users within each department, and the associated costs.

- License Reallocation: Zluri also helps finance managers reallocate licenses efficiently. In cases where some licenses are underutilized in one department but needed in another, Zluri highlights this, enabling the reassignment of licenses to minimize expenses.

But how can your finance team access insights into app usage?

Here's a step-by-step guide to help your finance team access department-wise app usage details through Zluri: - Step 1: Begin by navigating to the application module within Zluri's main interface. Select the specific application you want to examine in detail.

- Step 2: Upon selection, you will be directed to the default overview page. This page presents a comprehensive summary of the chosen application, including information such as the number of active users, the departments utilizing the application, upcoming renewal dates, and more.

- (Note: If you wish to delve deeper into individual user usage, including whether they are actively using the app or not, you can access this information by clicking on the "user" tab.)

- Step 3: For a closer look at the financial aspects, such as the actual expenditure and estimated costs associated with the selected application, simply click on the "spend" tab.

- By following these steps within Zluri, your finance team can easily access and analyze department-wise app usage details, enabling more informed decision-making and cost management.

Simplifying SaaS Purchasing

Zluri offers significant advantages for finance managers when it comes to simplifying SaaS purchasing. Here's how Zluri can help streamline your SaaS procurement process:

- SaaS Buying Capabilities: Zluri extends its functionality beyond SaaS management and includes SaaS buying capabilities. This means that in addition to managing your existing software subscriptions, it can assist you in the procurement of new SaaS applications.

- Expert Negotiation: Zluri employs experts who specialize in negotiating SaaS contracts. These professionals understand the nuances of the SaaS market, pricing structures, and vendor dynamics. You can rely on these experts to secure the best possible deal for their organization.

- ZOPA (Zone of Possible Agreements): Zluri's negotiation approach incorporates the concept of ZOPA, which stands for Zones of Possible Agreements. This concept is particularly beneficial for finance managers working within budget constraints. Here's how it works:

Imagine you have a budget of $40,000 for purchasing a specific SaaS application. Market research reveals that vendors offer the same SaaS app at prices ranging from $35,000 to $45,000.

In this scenario, the ZOPA is the range between your spending limit ($40,000) and the vendor's price range ($35,000 to $45,000).

Armed with this understanding, Zluri's experts can negotiate on your behalf with confidence. They aim to secure the SaaS app for a price closer to the lower end of the vendor's range, around $35,000, all while ensuring the vendor still makes a reasonable profit.

- BATNA (Best Alternative To a Negotiated Agreement): Another negotiation strategy employed by Zluri is BATNA. This is especially valuable when you have multiple options and want to ensure you get the best value for your money.

Here's an example:

You are negotiating a service agreement with a preferred vendor who is charging $20,000 annually. However, you've received estimates from other vendors offering the same services for $17,000 and $15,000 annually.

In this case, your best alternative is to choose one of the other vendors if your preferred vendor's price exceeds your budget.

With this information in hand, Zluri's experts can negotiate with your preferred vendor to secure the service for a price closer to $17,000 or $15,000 annually. They can also use your BATNA as leverage during negotiations, giving you the flexibility to switch to a different vendor if the preferred vendor cannot match the desired price point.

So what are you waiting for? Book a demo now and see for yourself!

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.webp)

.webp)

.webp)

.webp)