CFOs can identify cost-saving opportunities, eliminate unnecessary expenses, and ensure they get the most value for their investment by implementing strategies to optimize SaaS spend.

In the fast-paced digital era, software-as-a-service (SaaS) has become an integral part of IT operations for many organizations. While SaaS can provide significant benefits, it's important for CFOs to optimize their spend and ensure they get the most value for their investment.

However, certain challenges hinder CFOs from optimizing SaaS spend. For example, it becomes difficult for the finance team to keep track of SaaS spend while managing a large number of SaaS apps. Also, often, SaaS spend hides in the shadow of recurring subscription fees, which are difficult to identify, and this silently drains financial resources and erodes profitability.

So how can you, as a CFO, optimize SaaS spend in such a scenario? You can implement certain effective cost-saving strategies to minimize and control your organization's Saas spend and focus on maximizing return on investment.

With that in mind, we've compiled a list of 4 proven strategies, from conducting regular software audits to negotiating contracts. These strategies are designed to help CFOs make informed decisions and drive better outcomes.

So if you're looking to get the most out of your SaaS investments, read on to discover our top strategies.

3 Effective Strategies For CFOs To Optimize Spending

Below we'll discuss in detail the challenges associated with SaaS spend and will provide you with effective solutions to optimize and maximize the utilization of your SaaS investments.

1. Identifying The Hidden Spend

Before your finance team identifies the hidden spend, they first need to understand what it means. Hidden spend is the unnoticed and often-overlooked expense that takes place in your organization, every now and then. Below listed are a few forms of hidden spend:

- Shadow IT is a prime culprit of contributing to hidden spend in your organization. It occurs when your employees procure and use SaaS applications without the IT team's knowledge or approval. Due to this, your finance team cannot identify the unknown expenses associated with such purchases, and the SaaS budget continues to leak.

- Furthermore, your employees unknowingly end up purchasing SaaS applications whose features are provided by other apps already existing in your organization's SaaS stack. This leads to purchasing duplicate and redundant apps, giving way to unnecessary SaaS expenses.

- Also, at times it happens that after using the SaaS app licenses for a while, your employees stop using them, and you may end up paying for unused or underutilized app licenses in next year’s renewal. This again adds to the SaaS spend.

- Lastly, hidden charges originate from true-up cost, i.e., the difference between cost and actual spend. For instance, if you bought 100 licenses for an app at the beginning of the year, each license cost is $10, so the total cost of the contract comes to $1000. Now, by the mid of the year, 20 more employees joined, and you require 20 more licenses for the same app, so you pay $200 for those licenses.Technically now the first year total spend is $1200. However, you paid $1000 for the contract, so the difference between the actual spend (which comes from finance and expense management) and the cost (which comes from the contract) is $200. This $200 is the hidden charge. So how do hidden charges become a barrier to optimizing SaaS spend? When finance teams practice manual methods, they fail to accurately assess the spend, due to which they get inefficient data. Thus, while calculating the hidden charges, the result varies and doesn't show actual expenses.

How Can You Mitigate These Challenges?

You can opt for an effective SaaS management platform (SMP) such as Zluri. What is Zluri? How can it help you identify hidden spending?

Zluri is an intelligent SMP that helps your team discover all the SaaS apps present in your organization's SaaS stack with its nine discovery methods, i.e., MDMs, IDPs & SSO, direct integration with apps, finance & expense management systems, CASBs, HRMS, directories, desktop agents (optional), and browser extension (optional).

Zluri’s nine discovery methods

This allows your team to eliminate shadow IT, which further helps your finance team identify which applications subscriptions they are paying for.

Furthermore, with Zluri, your team can obtain all the application details that help in analyzing which applications offer similar features. Accordingly, your finance team can discontinue the subscriptions for duplicate and redundant SaaS apps, cutting down on SaaS costs.

Zluri doesn't stop here; as per Kuppingercole's report, it even provides details of underutilized and unused licenses; with the help of this data, your finance team can decrease, reallocate, or right-size the licenses. For instance, you bought 10 licenses for an app and allotted 5 licenses to the procurement department and 5 to the marketing department. The marketing department used only 3 of the licenses, and the procurement team used all 5.

So what Zluri does is it acquires the related data and updates the same on its centralized dashboard. Now, your finance team can check which licenses are unused and accordingly eliminate those licenses or reassign them to other departments.

Apart from that, to find the hidden charges, Zluri provides your finance team with the cost and actual spend (YTD) data, which helps them to identify the difference and obtain accurate expense data.

2. Monitor SaaS Renewals

To complete certain projects, your employees sign up for applications; however, once the task is completed, they forget to discontinue the subscription or make your IT team aware of the same.

As a result, due to automatic renewal, your finance team continues to incur costs for applications that are no longer in use.

For instance, the IT team procured a Hubspot app for a new project for the marketing team. The team completed the project within 6 months, and after that, they stopped using the application without canceling their subscription.

This resulted in the application being auto-renewed on a monthly basis despite its non-usage.

How can your finance team monitor SaaS renewals effectively?

With Zluri's renewal calendar, your finance team stays informed about upcoming renewals. This enables them to make well-informed decisions regarding the continuation or cancellation of subscriptions and contracts by assessing app usage, prior to the deadline. Furthermore, your finance team can view all the payments and contracts month-wise in the renewal calendar.

Apart from that, it also offers the flexibility to prioritize renewals based on specific requirements. For instance, if a payment involves a huge amount, your finance team can prioritize that particular renewal first. Additionally, they get the ability to manually set alerts at their convenience, allowing them to stay updated on important renewal deadlines.

However, by default, your finance team will receive timely alerts for contracts 30, 15, 7, and 1 days prior to renewal, while for payments, they will receive alerts 7 and 1 days prior to renewal. This comprehensive system ensures they have full control and visibility over the renewal processes.

3. Understand Software Usage

Finance teams often struggle to gain complete visibility into software usage when they rely on manual methods for obtaining insights. This limitation hinders their ability to accurately identify the app features that are actively utilized and those that remain unused, consequently resulting in potential SaaS cost leakage.

How can one understand software usage?

So Zluri effectively addresses this challenge by offering your finance team valuable software usage insights. It empowers them to identify precisely which employees are actively utilizing specific app features and which ones remain untouched.

With the help of this information, your finance team can make informed decisions and shift to a more suitable tier or downsize to a suitable tier, ensuring they only pay for the features that the employees are actively using. This intelligent approach optimizes resource allocation and reduces the chances of SaaS cost leakage.

To make you understand better, let's assume a scenario, an employee has a paid version of Zoom but doesn't conduct meetings that exceed 40 minutes. In such instances, Zluri offers app usage insights to your finance team, indicating that the paid version may not be necessary for these users.

With the help of this data, your finance team can make an informed decision and switch to a free plan. By doing so, your finance team can avoid paying for features that are not being used, helping in reducing unnecessary expenses.

Keep Track Of Employees/Department App Usage

It is crucial for your finance team to conduct a thorough evaluation of how employees and departments utilize SaaS applications, as any misinterpretation can result in unnecessary SaaS cost expenditures.

For example:

- Applications that are frequently used and crucial for employee roles, your finance team can negotiate a multi-year deal with the vendor. This way, your team can save costs in the long run.

- Applications that employees don't use but are crucial for their roles, your finance team can find suitable substitutes for the app. By doing so, your team can avoid unnecessary expenses and provide employees with the applications they require.

- Applications that employees neither use nor are critical for their job functions can be discontinued altogether. By simply discontinuing the app licenses,your finance team can eliminate unnecessary costs associated with unused software.

As for departments, your finance team needs to find which application licenses are used or underutilized by each department.

For instance, your team allotted 10 licenses of an app to the finance department and 10 licenses of the same app to the HR department. However, the finance department made use of the licenses, but the HR department only used 7 out of 10 licenses. After a while, a few more employees joined the finance department, and now they need more app licenses. What can be done in this situation?

So, your 3 licenses are going to waste; what your finance team can do is reassign those licenses to the finance department and purchase more if required. By doing so, they will minimize the SaaS expenses, and also, your licenses won't go to waste.

By carefully assessing usage patterns and aligning them with the importance of each application, your finance team can optimize SaaS costs and make informed decisions.

How can one keep track of department wise app usage?

Zluri provides your finance team with all app usage details in a centralized dashboard. This allows your finance team to gain a complete understanding of which departments are utilizing the licenses, the percentage of users within each department, and the corresponding expenditure incurred.

With this information at hand, your finance team can accurately track and analyze the distribution of costs across different departments, enabling them to make informed decisions regarding budget allocation and optimization.

How can your finance team view app usage details?

Below are the steps that will help your finance team to view department-wise app usage:

- Step 1: From Zluri's main interface, click on the application module and click on any application that you wish to view the details of.

- Step 2: Now you will land on the overview page by default; it will display all the application details, how many users are actively using that application, which departments are using the application, upcoming renewals, and more.

Note: You can also view which employees are using the application and view their status ,whether they are actively using the app or not, by clicking on the user's tab.

Also, you can check the actual spend and estimated cost by clicking on the spend tab.

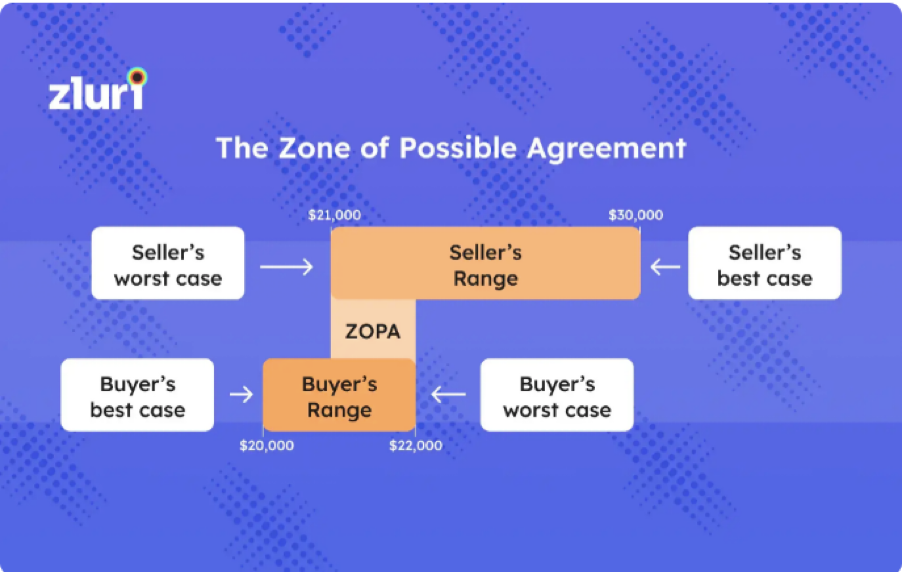

However, Zluri is not restricted to this only; it further offers SaaS buying capabilities making app purchasing less complicated. It allows experts to negotiate for the best deal on behalf of your procurement team while procuring a new SaaS app. These experts use two negotiation ways, i.e., ZOPA (Zones of Possible Agreements) and BATNA (Best Alternative To a Negotiated Agreement).

Let's take an example to make you understand better, you have a budget of $ 40,000 and want to purchase a SaaS from a vendor. When you conduct market research, you find out that vendors offer the required app for between $35,000 and $ 45,000. So in this scenario, the ZOPA is the difference between your spending limit and the vendor's price range of $35,000 to $45,000.

With the help of this information, Zluri's experts can confidently negotiate on your behalf and get the SaaS app for a price closer to $35,000 while ensuring the vendor makes a profit.

Another scenario can be, considering that you and a vendor are negotiating a new service agreement. Your preferred vendor is charging $20,000 per year for the service. However, you have received estimates for $17,000 and $15,000 annually from other vendors who are giving the same services. In this case, your best option is to choose one of the other vendors if the desired vendor's price is out of your price range.

With this knowledge, Zluri's experts can bargain with the preferred vendor to try and get the service for closer to $17,000 or $15,000 annually. Also, you can use your BATNA and select a different vendor if the preferred vendor cannot match this price.

So this is how Zluri helps your finance team optimize your SaaS spend effectively. You can book a demo now and see for yourself how it significantly reduces your SaaS expenses from day one of deployment.

.svg)