While collaborating with third-party vendors, you grant them access to sensitive data and entrust them to handle critical tasks. This means if vendor access is not managed carefully, it can lead to potential data breaches and service disruption. To avoid such pitfalls, having a vendor risk management policy becomes crucial. In this article, we’ll explore this critical concept in detail.

The risks associated with third-party vendors are multifaceted, ranging from cybersecurity threats and data breaches to operational disruptions, regulatory non-compliance, and reputational damage.

Last year, over half (52%) of cybersecurity professionals experienced an increase in cyber-attacks compared to a year ago. A single vendor-related incident can have severe consequences, including financial losses, legal liabilities, and erosion of customer trust.

Therefore, organizations must adopt a comprehensive and proactive approach to vendor risk management to manage these risks effectively. This is where a well-designed vendor risk management policy comes into play. But what is vendor risk management policy?

What Is Vendor Risk Management Policy?

A vendor risk management policy (VRMP) is a document that outlines an organization's approach to identifying, assessing, and managing the cybersecurity risks third-party vendors pose.

This stems from the need for vendor management, which is the systematic process of vetting, onboarding, monitoring, and offboarding third-party vendors and suppliers that an organization works with.

Furthermore, this policy defines the processes, roles, responsibilities, and controls required to ensure vendors meet the organization's security, compliance, and operational standards throughout their engagement lifecycle.

But what is the primary objective of vendor risk management policy?

The primary objectives of a vendor risk management policy are to:

- Establish a consistent and standardized approach to vendor risk management across the organization.

- Define clear roles and responsibilities for stakeholders involved in vendor management activities.

- Outline the processes and criteria for vendor due diligence, selection, contracting, and ongoing monitoring.

- Specify the security, compliance, and performance requirements that vendors must meet.

- Establish protocols for incident response, breach notification, and vendor termination/offboarding.

- Ensure alignment with relevant industry regulations, standards, and best practices.

But why exactly is it important to have a vendor risk management policy? Let’s understand.

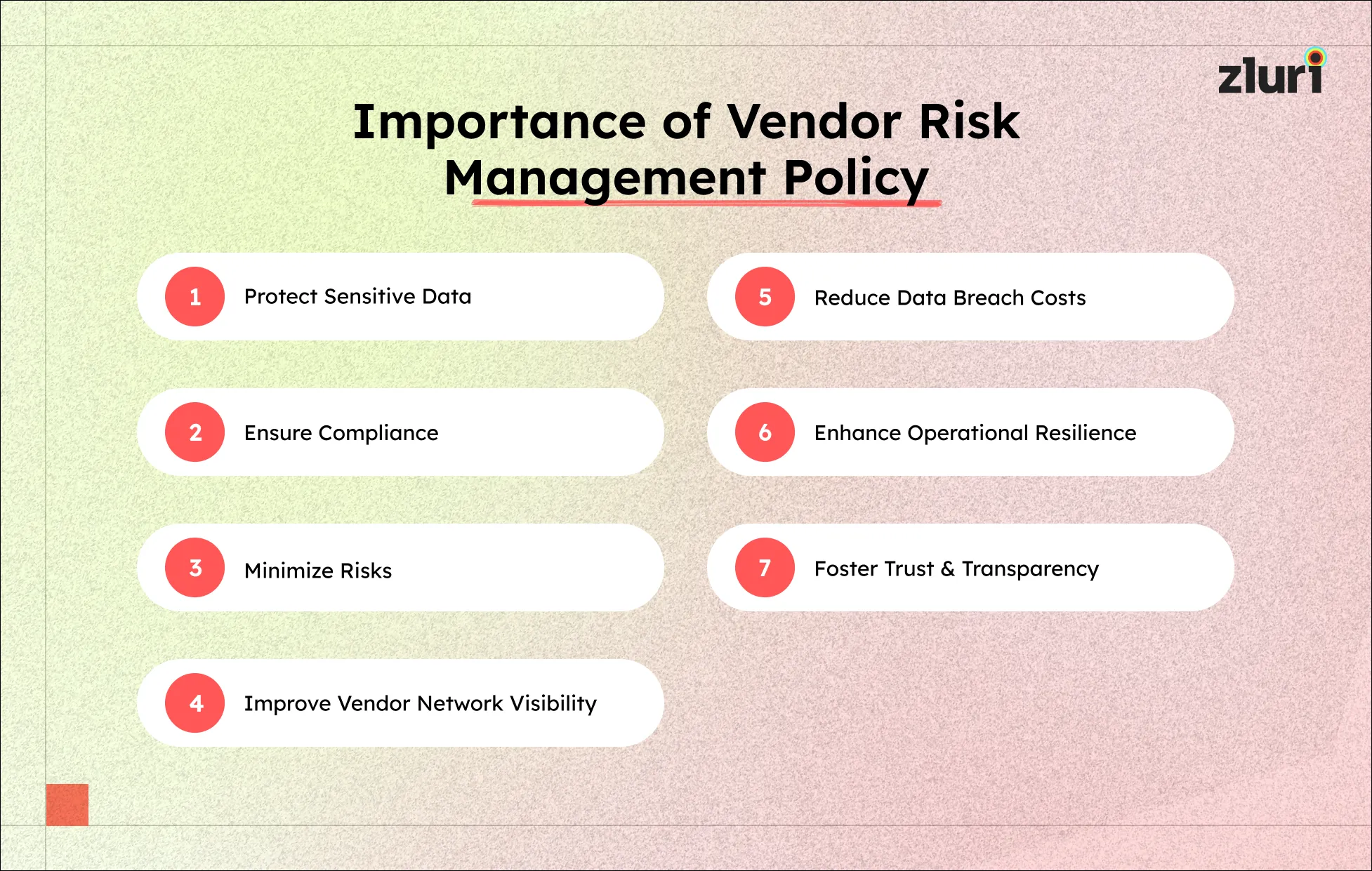

The Need For Vendor Risk Management Policy

A well-designed vendor risk management policy is crucial for several reasons:

- Protects Sensitive Data

Many vendors can access an organization's sensitive data, including customer information, intellectual property, and trade secrets. A vendor risk management policy helps establish controls to limit data access and protect against unauthorized exposure or misuse, reducing the risk of costly data breaches.

- Ensures Compliance

Various industries are subject to specific compliance requirements, such as HIPAA for healthcare, PCI DSS for payment card processing, and GDPR for data privacy. A robust vendor risk management policy helps your team ensure that their vendors adhere to these regulatory obligations, minimizing the risk of non-compliance penalties and legal liabilities.

- Minimizes Risks

Third-party vendors can introduce various risks, including cybersecurity threats, operational disruptions, financial instability, and reputational damage. A vendor risk management policy enables your team to proactively identify and mitigate these risks, reducing their overall risk exposure.

- Improves Vendor Network Visibility

Implementing a vendor risk management policy enables your team to gain better visibility into their vendor networks, enabling them to understand potential vulnerabilities, dependencies, and interconnections. This visibility is crucial for implementing effective risk mitigation strategies and maintaining situational awareness.

- Reduces Data Breach Costs

Data breaches involving third-party vendors can be devastating, resulting in significant financial losses, regulatory fines, and reputational damage. So, by implementing this policy, you can significantly lower the likelihood and impact of such breaches, helping organizations avoid costly consequences.

- Enhances Operational Resilience

A vendor risk management policy can improve an organization's operational resilience by establishing clear protocols for vendor monitoring, incident response, and contingency planning. This ensures business continuity in the event of vendor-related disruptions or failures.

- Fosters Trust & Transparency

Implementing a vendor risk management policy demonstrates an organization's commitment to security and risk management, fostering trust and transparency with stakeholders, including customers, partners, and regulatory bodies.

After going through the importance, you may consider creating a vendor risk management policy for your organization. But isn't aware of how to create one? Below, we've outlined a few steps your team can follow to create an effective risk management policy.

How To Create An Effective Vendor Risk Management Policy?

Creating an effective vendor risk management policy requires a structured approach and collaboration across different organizational functions. The process should involve the following key steps:

Step 1: Assemble a Cross-Functional Team

Establishing a cross-functional team is crucial for developing a comprehensive vendor risk management policy that addresses various stakeholders' diverse perspectives and concerns. The team should include representatives from IT, cybersecurity, legal, compliance, procurement, finance, business operations, subject matter experts, and senior management.

Step 2: Evaluate Existing Vendors

Conduct a thorough assessment of all current third-party vendors, contractors, and suppliers. This assessment should involve:

- Identifying all vendors

- Categorizing them based on the level of risk they pose to the organization

- Evaluating their current security posture, compliance status, and performance

Step 3: Define Policy Elements

Outline the key components of the vendor risk management policy based on the organization's specific requirements and the risks identified during the vendor assessment. These elements should include:

- Purpose and scope

- Roles and responsibilities

- Definitions of key terms

- Vendor assessment and due diligence processes

- Compliance criteria

- Vendor lifecycle management procedures

- Enforcement mechanisms.

Step 4: Develop Vendor Assessment Criteria

Establish clear criteria for evaluating potential vendors, considering factors such as their cybersecurity practices, data handling procedures, financial stability, business continuity plans, and compliance with relevant regulations and industry standards.

Step 5: Implement Vendor Onboarding and Offboarding Processes

Define structured processes for onboarding new vendors, including due diligence activities, risk assessments, contract negotiation, and access provisioning. Similarly, establish procedures for offboarding vendors when agreements expire or are terminated, ensuring secure data transfer or disposal and access revocation.

Step 6: Define Continuous Monitoring Procedures

Implement ongoing monitoring and periodic reassessments of vendors to ensure their continued compliance with the organization's standards and to identify any emerging risks or performance issues. This may involve regular security audits, vulnerability assessments, and performance reviews.

Step 7: Establish Incident Response and Breach Notification Protocols

Develop clear protocols for responding to incidents involving vendors, such as data breaches, service disruptions, or non-compliance events. Define procedures for notifying affected parties, regulatory authorities, and other stakeholders and steps for incident containment, investigation, and remediation.

Step 8: Train and Educate Stakeholders

Provide comprehensive training and awareness programs to ensure that all relevant stakeholders, including employees, vendors, and third-party partners, understand their roles and responsibilities under the vendor risk management policy. Regular training and communication are essential for ensuring policy adherence and maintaining a strong security culture.

Step 9: Continuously Review and Update the Policy

Recognize that vendor risk management is an ongoing process. Regularly review and update the vendor risk management policy to reflect changes in the organization's requirements, evolving threats, and emerging regulations or industry standards. Establish a formal review and update cycle to ensure the policy remains relevant and effective.

Note: It is crucial to involve stakeholders from across the organization throughout the policy development process. The policy should also be aligned with industry best practices, relevant regulatory requirements, and the organization's overall risk management strategy.

However, you also need to be aware of what needs to be included in a vendor risk management policy to create an effective one for your organization.

What To Include In A Vendor Risk Management Policy?

A vendor risk management policy should address various aspects of the vendor lifecycle, from initial due diligence and onboarding to ongoing monitoring and offboarding.

While the specific contents may vary based on an organization's unique requirements and risk profile, a well-designed vendor risk management policy should typically include the following key components:

- Purpose and Scope: Clearly state the purpose and objectives of the policy, as well as the types of vendors and third-party relationships it covers. This section should define the scope of the policy, including any exceptions or exclusions.

- Roles and Responsibilities: Define the roles and responsibilities of various stakeholders involved in vendor management activities, such as the vendor management team, business units, legal, compliance, IT, and security departments. Clearly outline the accountabilities and decision-making authorities for each role.

- Definitions: Provide clear definitions of important terms used throughout the policy, such as "vendor," "third-party," "critical vendor," "sensitive data," and "risk assessment." Establishing a common vocabulary helps ensure consistent understanding and application of the policy across the organization.

- Vendor Assessment and Due Diligence: Outline the processes and criteria for assessing potential vendors, including security assessments, financial reviews, background checks, and compliance evaluations. This section should define the specific due diligence activities required based on the vendor's risk profile and the sensitivity of the services or data involved.

- Vendor Selection and Contracting: Establish guidelines for selecting vendors, negotiating contracts, and defining service-level agreements (SLAs) and performance metrics. Specify the requirements for contractual clauses related to security, data protection, incident response, and termination procedures.

- Vendor Access and Data Handling: Define the protocols for granting vendors access to the organization's systems, data, and facilities and the requirements for secure data handling, transmission, and storage. This section should address access control measures, encryption standards, and data classification protocols.

- Vendor Monitoring and Auditing: Specify the procedures for ongoing monitoring and periodic auditing of vendors to ensure compliance with contractual obligations and security standards. This may include regular security reviews, vulnerability assessments, and performance evaluations.

- Incident Response and Breach Notification: Outline the steps to be taken in case of a security incident or data breach involving a vendor, including breach notification procedures, incident response protocols, and remediation processes. Define the roles and responsibilities of various stakeholders during incident response.

- Vendor Offboarding and Termination: Establish procedures for terminating vendor relationships, revoking access privileges, and securely transferring or disposing of the organization's data and assets. This section should address data retrieval, secure data destruction, and the revocation of physical and logical access.

- Policy Enforcement and Exceptions: Clearly define the consequences for non-compliance with the vendor risk management policy, such as contractual penalties, termination of vendor relationships, or internal disciplinary actions. Additionally, outline the process for granting exceptions or waivers in specific situations, including the required approvals and documentation.

- Policy Review and Update: Specify the frequency and process for reviewing and updating the vendor risk management policy to ensure it remains aligned with the organization's evolving requirements, emerging threats, and changes in relevant regulations or industry standards.

Now that you know what’s involved in vendor risk management policy, let’s go through best practices to ensure the effective implementation of this policy within your organization.

Best Practices For Vendor Risk Management Policy

While the specifics of a vendor risk management policy may vary based on an organization's unique requirements and risk profile, several best practices can help ensure its effectiveness:

- Have Contingency Plans for Vendor Failures

Develop contingency plans to mitigate the impact of vendor service disruptions or failures, including identifying alternative vendors, implementing business continuity plans, and establishing communication protocols with affected stakeholders.

- Assign Dedicated Vendor Managers

Appoint dedicated vendor managers responsible for overseeing and managing the relationships with specific vendors. These individuals should deeply understand the vendor's services, contractual obligations, and performance metrics and should serve as the primary point of contact for addressing issues or concerns.

- Apply Standards Consistently Across Vendors

Ensure that all vendors, regardless of size or importance, are held to the same security, compliance, and performance standards defined in the vendor risk management policy. Avoid creating exceptions or applying different standards based on vendor size or influence.

- Keep the Policy Concise and Accessible

While comprehensive, the vendor risk management policy should be concise, well-organized, and easy to understand. Avoid unnecessary complexity or ambiguity, and ensure that the policy is readily accessible to all relevant stakeholders, including vendors themselves.

- Review and Update Policy Regularly

Review and update the vendor risk management policy regularly to reflect changes in the organization's requirements, emerging threats, evolving regulations, and industry best practices. Establish a formal review cycle (e.g., annually or bi-annually) and involve relevant stakeholders in the update process.

- Align with Security Frameworks and Standards

Leverage widely recognized security frameworks and standards, such as ISO 27001, NIST Cybersecurity Framework, and SOC 2, to establish vendor security and compliance requirements. Prioritize working with vendors that have achieved relevant certifications or attestations.

- Foster Collaboration and Communication

Encourage collaboration and open communication among all stakeholders involved in vendor management activities, including business units, IT, security, legal, and compliance teams. Establish regular meetings or forums to discuss vendor-related issues, share best practices, and coordinate risk mitigation efforts.

- Leverage Automated Tools and Platforms

Implement automated tools and platforms to streamline vendor risk management processes, such as vendor risk assessments, continuous monitoring, reporting, and documentation. Automation can help reduce manual effort, improve efficiency, and enhance visibility into vendor risks and performance.

- Conduct Regular Training and Awareness Programs

Provide ongoing training and awareness programs to ensure all stakeholders, including employees, vendors, and third-party partners, understand their roles and responsibilities under the vendor risk management policy. Regular training helps reinforce a strong security culture and promotes policy adherence.

- Foster Trust and Transparency with Vendors

Establish open and transparent communication channels with vendors and encourage them to proactively disclose potential risks or issues. Foster a collaborative relationship based on trust and shared responsibility for managing risks effectively.

By following these best practices and continuously refining and updating the vendor risk management policy, organizations can establish a robust framework for managing third-party vendor risks. This will help them protect sensitive data and systems, maintain regulatory compliance, and safeguard their operations from disruption and reputation.

After going through the best practices, you may realize that implementing and maintaining an effective vendor risk management program can be complex, particularly for organizations with large vendor ecosystems or limited in-house expertise.

To simplify the process, you can consider implementing Zluri. What is Zluri? How does it work? Here's a quick read-through.

Simplify Implementation Of Vendor Risk Management Policy Via Zluri

With its advanced features, Zluri offers a SaaS management solution that helps streamline vendor risk management processes. How do these features help? Here's how:

- Centralized Contract Management: Zluri's centralized contract and metadata repository consolidates all agreements, eliminating the hassle of scattered contracts. Vendor agreements and associated details reside in a single, easily accessible location, simplifying retrieval during contract renewals, audits, or renegotiations. With all contracts readily available, you can efficiently review terms and identify optimization opportunities.

- Compliance and Risk Mitigation: Zluri's SMP helps ensure compliance with vendor risk management policy, regulatory requirements, and industry standards by providing visibility into vendor relationships. It also helps identify and mitigate risks associated with vendor agreements, reducing the potential for legal and financial liabilities resulting from policy non-compliance.

- Vendor Management and Chargebacks: Zluri's SMP enables efficient vendor management by consolidating critical information into a single hub. Your team can track each vendor's contract status, spending, cost, and categorization. Additionally, Zluri's SMP supports chargebacks, allowing your team to accurately allocate costs to departments based on their application usage.

Book a demo today to optimize your vendor risk management policy and streamline your vendor management processes.

Vendor Risk Management Policy: A Strategic Measure To Address Potential Vendor Risks

In conclusion, a vendor risk management policy is crucial for any organization engaging with third-party vendors to prevent the compromise of sensitive data, operational disruptions, and other potential risks. To ensure this policy meets your organization's specific requirements, consider creating one and incorporating key elements, such as vendor assessment and due diligence, vendor access, vendor termination, etc.

Furthermore, to ensure effective policy implementation, you can follow vendor risk management best practices and deploy an automated tool, like Zluri's SaaS management solution.

Frequently Asked Questions (FAQs)

1. What is a third-party vendor risk management policy?

A third-party vendor risk management policy is a comprehensive document that outlines an organization's approach to identifying, assessing, and mitigating the risks associated with engaging third-party vendors and suppliers. It establishes the processes, controls, and requirements that vendors must meet to protect the organization's sensitive data, systems, and operations.

2. What are critical vendors?

Critical vendors are third-party providers with access to an organization's sensitive data, systems, or processes essential to its operations. Examples include cloud service providers, managed security providers, payment processors, and vendors handling personal health information.

3. How often should a vendor risk management policy be reviewed and updated?

It is generally recommended that a vendor risk management policy be reviewed and updated annually or whenever significant changes occur within the organization or its vendor ecosystem. Regular reviews ensure that the policy aligns with evolving business requirements, emerging threats, and relevant regulations or industry standards updates.

.svg)