IT Teams

• 12 min read

CapEx vs OpEx: A Guide for IT Teams

17th January, 2024

SHARE ON:

Careful financial planning and precise management of expenses are crucial elements in successfully navigating the complex landscape of business operations.

At the core of this financial strategy are two essential components: Capital Expenditure (CapEx) and Operating Expenditure (OpEx), which serve as fundamental pillars. Let's explore the distinguishing factor between CapEx vs OpEx that set apart.

Capital Expenditure (CapEx) and Operating Expenditure (OpEx) are distinct yet interwoven elements that form the backbone of financial planning, each playing a pivotal role in shaping a business's trajectory.

Understanding the CapEx vs OpEx contrasts between these pillars of expenditure is not merely beneficial; it's an essential compass guiding businesses toward prudent decision-making, financial stability, and sustained success in an ever-evolving marketplace.

Before delving into their distinct factors, let's first understand what capital expenditure and operating expense are.

What is Capital Expenditure?

A capital expenditure, often abbreviated as CapEx, refers to a substantial payment made by a company or organization to acquire assets or services that offer enduring benefits. These expenditures typically involve significant initial costs but are aimed at enhancing the business's overall efficiency, productivity, or capacity over an extended period.

CapEx essentially revolves around strategic investment and expected returns. It involves allocating funds towards assets or initiatives that contribute to the long-term growth and success of the business.

By making these investments, companies aim to generate value and reap benefits that extend well into the future rather than focusing solely on immediate gains.

Significance of CapEx

CapEx holds significant importance for several reasons:

Asset Acquisition: CapEx allows you to acquire assets crucial for your operations, such as machinery, equipment, technology, or property. These assets enable improved efficiency, expanded capacity, or upgraded infrastructure.

Long-term Growth: Investments through CapEx are geared towards long-term growth rather than immediate gains. They pave the way for expanded production capabilities, enhanced product quality, or increased service offerings, positioning the company for sustained growth.

Competitive Edge: Upgrading or acquiring new assets through CapEx can provide a competitive advantage. It allows businesses to stay current with technology, offer better quality products or services, and potentially outperform competitors.

Productivity and Efficiency: Capital expenditures often aim to streamline processes, automate tasks, or improve efficiency. This, in turn, can lead to increased productivity, reduced costs, and better utilization of resources.

Regulatory Compliance and Safety: Upgrading equipment or infrastructure through CapEx can ensure compliance with industry standards and regulations. It also contributes to maintaining a safe working environment for employees.

Examples of CapEx

CapEx encompasses strategic investments in long-term assets essential for technological infrastructure and development.

Software Acquisitions: Purchasing software licenses or development tools required for long-term use falls under CapEx. This includes enterprise resource planning (ERP) systems, customer relationship management (CRM) software, or proprietary software developed for the company's specific needs.

Cloud Computing Investments: Adopting cloud services, while often considered operational expenses, certain strategic investments in cloud infrastructure, like establishing private cloud environments or acquiring long-term cloud service contracts, can be categorized as CapEx.

IT Security Enhancements: Investing in cybersecurity infrastructure, such as firewalls, intrusion detection systems, or encryption technology, to fortify the company's digital assets and protect against cyber threats qualifies as CapEx.

Research and Development (R&D): Funding for technology-driven R&D initiatives to create new products, services, or proprietary technology qualifies as CapEx. This includes expenses incurred in innovation labs, experimental projects, or prototyping new technologies.

Common Challenges in Managing CapEx

Managing CapEx can pose several business challenges, influencing strategic decision-making and financial planning.

Budget Allocation Complexity: Businesses often encounter difficulties in allocating funds effectively among competing projects. Limited budgets force tough decisions, leading to project delays or the shelving of crucial initiatives. Prioritizing projects amidst various needs becomes a critical balancing act.

Long-term Planning and Adaptability: Planning for CapEx involves considering future scalability and technological advancements. Anticipating technological changes and ensuring investments' longevity and relevance over time is a challenge. Failure to do so could render assets obsolete or less effective in the long run.

Measuring Return on Investment (ROI): Determining the return on investment for capital projects is intricate due to multifaceted variables. Isolating the impact of an investment on financial returns amidst market fluctuations and evolving business landscapes is challenging. Comprehensive ROI measurement requires adaptable methodologies, incorporating sensitivity analyses and scenario planning to assess potential outcomes accurately.

Resource Allocation and Prioritization: Efficiently allocating resources among various CapEx projects is a constant challenge. Balancing short-term necessities with long-term strategic investments requires astute prioritization to maximize overall business value.

What is Operational Expenditure?

Operating expenses, often abbreviated as OpEx, encompass the day-to-day costs crucial for maintaining a business's regular operations. These expenses are fundamental for sustaining the business but typically do not directly contribute to long-term value creation or revenue generation.

They cover the routine expenditures necessary to keep the wheels turning, such as rent, utilities, salaries, and supplies. Unlike CapEx, which involves investments in assets intended to generate future benefits, OpEx is centered on current operational needs.

Understanding the balance between capital and operating expenses is vital for a company's short-term stability and growth trajectory. While capital expenditures focus on strategic investments for future gains, operating expenses are pivotal in immediate business functions, forming a cohesive approach for a company's sustained success.

Significance of OpEx

OpEx holds significant importance within a business for several reasons:

Performance Evaluation: Monitoring OpEx helps in evaluating the efficiency of business operations. Comparing these expenses over time or against industry benchmarks can provide insights into spend management and operational effectiveness.

Adaptability and Decision-Making: Understanding OpEx dynamics enables businesses to adapt to changing market conditions. It facilitates informed decision-making, allowing companies to adjust their operational strategies to remain competitive and agile.

Strategic Allocation of Resources: Balancing OpEx with CapEx is crucial for a company's long-term growth and stability. Strategic allocation of resources between these two types of expenses ensures a balance between immediate operational needs and future investments for growth and innovation.

Budgeting and Financial Planning: Understanding and controlling operating expenses is crucial for effective budgeting and financial planning. It allows businesses to allocate resources strategically, ensuring enough funds to cover operational costs.

Examples of OpEx

OpEx is critical in sustaining and managing the technological infrastructure and services. Some notable examples of OpEx specific to IT include:

Cloud computing costs: Expenses related to using cloud services, including computing resources (virtual machines), storage, data transfer, and additional services provided by cloud service providers like Amazon Web Services (AWS), Microsoft Azure, or Google Cloud Platform.

IT support and maintenance contracts: Payments for ongoing technical support, maintenance, and service contracts for hardware, software, or infrastructure components to ensure their proper functioning and troubleshooting.

Licensing fees: Fees associated with software licenses, including operating systems, productivity tools, security software, and other applications required for business operations.

Telecommunications expenses: Costs related to internet connectivity, phone lines, mobile services, and networking infrastructure necessary for day-to-day communication and data transmission within the organization.

Common Challenges in Managing OpEx

OpEx presents businesses with several challenges that impact their financial stability and competitive edge:

Cost Control and Variability: Day-to-day operational expenses often fluctuate based on production levels or sales volume. Variability in these costs makes predicting and controlling expenses challenging, impacting profit margins. Unforeseen increases in these expenses can strain budgets and hinder financial planning.

Market Volatility and Economic Factors: Businesses operate in dynamic markets influenced by fluctuations in commodity prices, inflation rates, and intensified competition. These external factors directly impact operational costs, requiring agile financial strategies to adapt and mitigate the effects of market fluctuations.

Operational Efficiency and Resource Optimization: Maximizing operational efficiency while minimizing costs is an ongoing challenge. Optimizing processes, streamlining workflows, and ensuring resource allocation aligns with operational needs are critical for reducing unnecessary expenses and enhancing productivity.

Risk Management and Compliance: Compliance requirements and unexpected risks can significantly impact OpEx. Adhering to regulatory standards and managing unforeseen risks, such as cybersecurity threats or supply chain disruptions, often necessitates additional expenditures, adding complexity to cost management.

How to Calculate CapEx and OpEx

Understanding CapEx and OpEx involves delving into your organization's financial data.

CapEx calculation involves scrutinizing the income statement and balance sheet. To calculate CapEx, start with the income statement to identify depreciation and amortization. Then, refer to the balance sheet to find the current period PP&E and the prior period PP&E.

Use this formula:

CapEx = (Current period PP&E - Prior period PP&E) + Current period depreciation

In simpler terms, this formula indicates that the change in PP&E over time, considering new capital expenditures and deducting depreciation, determines CapEx.

On the other hand, OpEx is more straightforward. It encompasses various operational expenses aggregated over a specific timeframe.

For instance:

Operating expenses = rent + insurance + supplies + licensing fees + legal fees + marketing and advertising + payroll and wages + repairs and equipment maintenance + taxes + travel + utilities + vehicle expenses

By summing up these operational costs over the designated period, you derive the OpEx figure.

Boiling it down, CapEx involves analyzing changes in PP&E and depreciation over time, while OpEx is the cumulative total of day-to-day operational expenses within a given period. Both these calculations are integral for assessing an organization's financial health and strategic planning.

What is the Difference between CapEx vs OpEx: 5 Key Factors

When distinguishing between CapEx vs OpEx, several key factors set them apart:

1. Nature of expenses

CapEx involves substantial financial commitments towards strategic investments for long-term growth and innovation. These investments represent a deliberate allocation of resources into assets or projects that contribute to the future value and expansion of the business.

CapEx initiatives are focused on bolstering the company's capabilities, productivity, or competitive edge over an extended period. This expenditure category encompasses vital acquisitions in infrastructure, technology upgrades, research and development endeavors, and any initiatives that foster sustained business advancement and evolution.

On the other hand, OpEx constitutes the continual financial outlays necessary for the day-to-day sustenance of business operations. This category encapsulates routine expenses indispensable for maintaining immediate functionality and operational needs.

OpEx covers essential costs associated with personnel, utilities, office supplies, and other necessities crucial for uninterrupted and seamless daily activities. However, unlike CapEx, which is geared towards long-term asset growth and value creation, OpEx primarily supports ongoing processes without directly contributing to significant long-term asset expansion or major value addition to the company.

2. Timeframe and Impact

CapEx encompasses investments that exert a profound and prolonged influence on a company's financial trajectory.

Long-Term Influence: CapEx involves investments with enduring effects on a company's financial landscape, spanning an extended period.

Gradual Bottom-Line Impact: These substantial and strategic expenditures gradually influence the company's financial standing and performance over time.

Strategic Planning for Future Growth: Investments in CapEx, such as infrastructure expansions or technology upgrades, are geared towards long-term growth and value creation.

Contribution to Company's Value Proposition: CapEx decisions contribute to the company's overall value proposition, impacting financial statements progressively and sustainably.

On the other hand, OpEx comprises immediate functionality and operational continuity of a company.

Immediate and Recurring Costs: OpEx encompasses immediate expenses vital for day-to-day business operations, incurred regularly.

Short-Term Financial Impact: These operational expenses immediately affect financial statements, influencing short-term profitability and cash flow.

Essential for Immediate Functionality: Costs such as salaries, utilities, and office supplies are necessary for immediate operational functionality.

Limited Impact on Long-Term Assets or Revenue: While crucial for immediate operations, OpEx doesn't directly contribute to long-term asset value or revenue generation.

3. Purpose and Focus

CapEx represents strategic investments to foster future revenue streams or enhance the business's intrinsic value. CapEx projects are pivotal in sculpting the company's growth trajectory, expanding capabilities, and establishing a foundation for sustained profitability.

These initiatives often involve substantial resources to acquire assets or undertake projects that promise long-term returns, elevating the company's competitive position and innovation potential.

OpEx sustains the day-to-day operational efficiency and functionality of the business. While crucial for ongoing activities, OpEx primarily addresses immediate necessities and maintenance rather than actively contributing to long-term revenue generation or significant value addition.

These expenses are vital for sustaining operations, ensuring continuity, and meeting current demands but generally do not directly fuel strategic growth initiatives or substantial transformative endeavors.

4. Returns on Investment

Returns on Investment (ROI) present different timelines and structures for CapEx vs OpEx:

Capital expenditure yields a gradual return over the life cycle of the invested asset. This extended timeframe reflects the long-term nature of CapEx investments. The initial substantial outlay is balanced by continuous returns or benefits spread across the asset's useful life.

These returns might encompass increased efficiency, enhanced productivity, or revenue generation, evolving steadily as the asset contributes to the company's operations.

Operational Expenditure, in contrast, generates returns in shorter billing cycles. These returns are more immediate and closely tied to the regular and ongoing expenses necessary for day-to-day operations.

In shorter intervals, these expenditures result in immediate benefits, facilitating the business's operational continuity and enabling it to function efficiently in the short term.

This distinction in return timelines emphasizes the different purposes and timeframes of CapEx and OpEx investments, highlighting how they contribute to the company's financial performance over varying durations.

5. Taxation treatment

Taxation treatment varies significantly for CapEx vs OpEx, impacting how businesses account for these expenses:

CapEx expenses related to long-term asset investments follow specific taxation guidelines:

Tangible Assets: Deductions occur over the asset's lifespan through a process called depreciation. This allows businesses to spread the cost of substantial purchases like machinery or property over the useful life of these assets.

Intangible Assets: Costs are amortized, meaning they are spread out over the life of the intangible asset, such as patents or trademarks.

By distributing the deduction over time, CapEx accounting recognizes the asset's gradual decrease in value and allocates tax benefits accordingly.

OpEx, covering day-to-day operational costs, has a different taxation approach:

Immediate Deduction: These expenses, such as rent, utilities, and salaries, are fully deductible in the same year they are incurred.

This immediate deduction offers businesses the advantage of reducing taxable income for the current fiscal period, providing an immediate tax benefit.

Understanding these differing tax treatments is critical for businesses. While CapEx allows for gradual deductions over the life of an asset, OpEx enables immediate tax benefits within the current fiscal year. These treatments influence financial planning, affecting when and how businesses can claim deductions to optimize their tax liabilities.

The Differentiation Table of CapEx vs OpEx

The following table explains the distinctive characteristics of CapEx vs OpEx, highlighting their differences in nature, impact, purpose, returns on investment, and taxation treatment.

Factors | CapEx | OpEx |

Nature of Expenses | Substantial investments for long-term growth and innovation. Focus on assets/projects for future value and expansion. | Ongoing costs for immediate operational needs. Addresses day-to-day sustenance without significant growth. |

Timeframe and Impact | Long-term influence on financial landscape over an extended period. Gradually affects financials, shaping performance over time. | Immediate impact on financial statements for short-term profit. Immediate influence on profitability and cash flow. |

Purpose and Focus | Enhances future revenue streams and intrinsic business value. Shapes growth trajectory, expands capabilities, and sustains profitability. | Maintains day-to-day operations but doesn't fuel long-term growth. Ensures immediate needs are met but doesn’t foster long-term growth. |

Returns on Investment (ROI) | Yields returns gradually over asset life cycle. Evolving benefits from assets contributing to company operations. | Immediate benefits ensure operational continuity in the short term. Fully deductible in the year incurred. |

Taxation Treatment | Deducted via depreciation (Tangible Assets) or amortization (Intangible Assets). Deductions spread over asset life, acknowledging gradual value decrease. | Fully deductible in the year incurred. Reduces taxable income for the current fiscal period immediately. |

These two types of expenditures play distinct roles in shaping a company's financial landscape and operational capabilities. Let's explore the fundamental disparities between CapEx vs OpEx across various key factors to comprehend their impact, purpose, and treatment in a business context.

The intricacies involved in managing these expenditures across various operational facets underscore the necessity for a comprehensive solution that simplifies this process. That's where Zluri comes in.

How Zluri Helps with SaaS Expense Management?

Optimizing SaaS expenditure is pivotal for enhancing cost-effectiveness and streamlining organizational operational efficiency. Zluri presents an all-encompassing SaaS management platform granting unparalleled authority over your expenditures.

Through a thorough analysis of software utilization and expenditure data, Zluri specializes in pinpointing dormant or underused licenses, identifying duplicate subscriptions, and revealing avenues for cost-efficiency enhancements.

This invaluable discernment empowers you to tailor subscriptions to precise needs, trimming extra expenses and ultimately fostering substantial cost reductions for your enterprise.

Here's how Zluri does it:

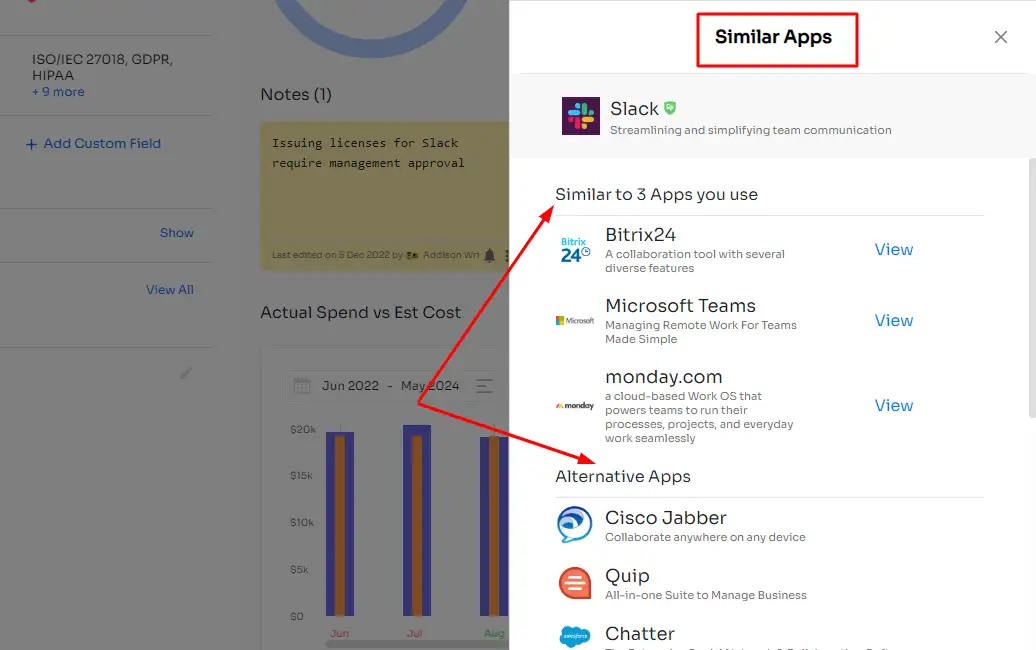

Identifying Similar or Redundant Apps

Zluri is crucial in identifying analogous or redundant applications within your organization's software ecosystem. Its robust SaaS management platform thoroughly examines your software portfolio, meticulously assessing applications that either serve comparable objectives or possess overlapping functionalities.

By leveraging analysis tools, Zluri scrutinizes the nuances of various software tools, shedding light on instances where multiple applications might be fulfilling analogous roles. This insightful assessment aids in recognizing potential overlaps, allowing for informed decisions regarding application consolidation or optimization strategies.

Ultimately, this proactive approach streamlines operations and cultivates a more efficient software environment, maximizing productivity and cost-effectiveness.

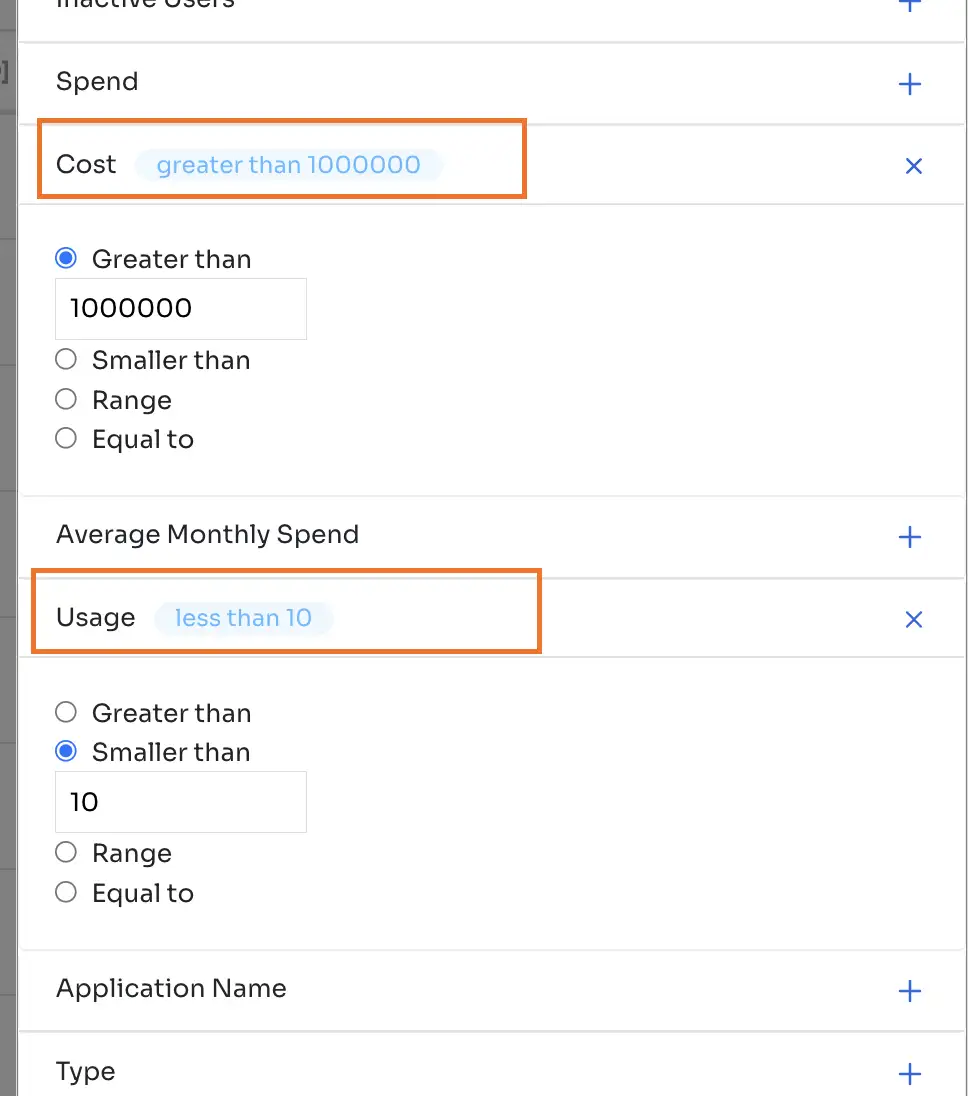

Identifying High-Cost, Low-Usage Apps

Zluri's functionality extends beyond identifying high-cost, low-usage applications. It furnishes a comprehensive overview of your organization's SaaS expenditure, encompassing both the actual expenses incurred and their estimated costs.

Through its robust analytical capabilities, Zluri allows for meticulous tracking and ongoing monitoring of all SaaS-related expenses, offering valuable insights into your expenditure patterns.

Actual Spend vs. Estimated Cost Overview:

This platform excels at comparing the real spend against the estimated cost, pinpointing any disparities. This analysis gives you the information needed to make effective, strategic decisions in optimizing your budget allocation.

By leveraging this feature, you gain a clear and detailed comprehension of your SaaS financials, enabling proactive management and precise control over your expenses.

By aligning the actual spend with estimated projections, Zluri empowers organizations to make informed decisions that streamline expenses and enhance fiscal control.

SaaS Budgeting and Forecasting:

Empowering proactive financial planning, Zluri facilitates establishing and monitoring real-time software expense budgets. The platform enables accurate and insightful forecasts of future expenditures by leveraging historical data.

This functionality equips businesses with the foresight needed to plan expenditures strategically, ensuring optimal allocation of resources and preemptive management of financial resources.

Spend Optimization Report

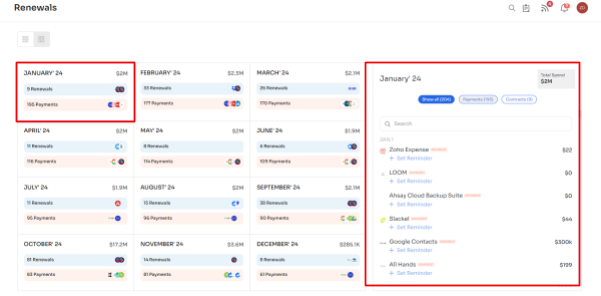

The Spend Optimization Report by Zluri significantly aids in effectively managing renewals, simplifying the process while strategically optimizing your SaaS contracts to amplify cost savings. This feature offers a user-friendly renewal calendar, aggregating all imminent renewals and contracts into a centralized hub for easy access and oversight.

Moreover, Zluri ensures timely reminders by dispatching alerts at crucial intervals before contract expiration, including notifications 30 days, 15 days, and 1 day in advance.

Additionally, it provides payment alerts 7 days and 1 day before the due date, ensuring you're well-prepared and informed well in advance, thereby reducing the risk of overlooked renewals or missed deadlines.

Renewal Management

Zluri offers a comprehensive suite of tools to streamline your renewal management process. Among its many capabilities, one standout feature is the ability to tailor email alerts precisely to your preferences. Whether you prefer reminders set at 30-day intervals or personalized schedules, this functionality ensures you stay on top of crucial renewal deadlines.

You can take timely actions by leveraging these email alerts, effectively orchestrating your renewals, and maintaining an organized approach. This not only aids in negotiating contracts but also helps sidestepping unnecessary expenses. Prioritizing high-value renewals becomes seamless, empowering your teams to allocate resources efficiently.

Zluri doesn't just stop at streamlining your processes; it enables you to take charge of your SaaS costs and optimize your investments.

By scheduling a demo, you'll experience firsthand how Zluri can empower you to maximize the value of your tech stack while efficiently managing your expenses.

FAQs:

1. What is CapEx used for?

CapEx refers to funds a company uses to acquire, upgrade, or maintain physical assets like property, buildings, equipment, or technology. It's a long-term investment in assets that are expected to provide benefits for a significant period, typically beyond one year.

2. How do CapEx and OpEx impact financial planning and budgeting?

CapEx involves big, periodic investments impacting long-term growth, while OpEx covers ongoing operational costs, affecting short-term financial plans and cash flow management.

3. How do CapEx and OpEx impact decision-making processes within a business?

CapEx decisions involve strategic planning and significant resources, shaping the company's long-term capabilities. OpEx decisions impact day-to-day operations and immediate financial health, both contributing to overall business direction and performance.

4. How does CapEx affect a company's financial statements?

CapEx impacts the balance sheet by increasing the value of assets. These expenditures don't immediately impact the income statement but are gradually expensed through depreciation, affecting profitability over time.

About the author

Shivam is a Product Manager at Zluri who is equipped with experience in scaling both B2B and B2C products. He was previously a founder at Autumn and has also done Product roles at Arrow. He’s a customer-centric product enthusiast with a tech inclination. He spends his off hours cycling, swimming or making new tunes in his guitar or piano.

Related Blogs

See More

Subscribe to our Newsletter

Get updates in your inbox