Vendor Management

• 6 min read

CIO CFO Collaboration - An Essential to SaaS Spend Management

1st May, 2023

SHARE ON:

Collaboration between CIOs and CFOs is essential for wise financial and technological decisions that drive growth in a company. This will also help companies transform their abilities and save costs while making data-driven decisions.

Let’s explore the reasons why CIOs and CFOs should collaborate and how Zluri can help streamline their collaboration.

In today's digital age, technology is critical in every aspect of an organization's operations. As such, the roles of the Chief Information Officer (CIO) and Chief Financial Officer (CFO) have become increasingly important.

The CIO manages the organization's information technology and ensures that it aligns with the overall business strategy. On the other hand, the CFO is responsible for managing the organization's finances and ensuring that they are optimized to support the business strategy.

CIOs and CFOs bring unique perspectives to the table. CIOs understand the latest technology trends and how they can be used to drive innovation. At the same time, CFOs deeply understand financial operations and can ensure that technology investments are made wisely.

While both roles have distinct responsibilities, it is important for the CIO and CFO to collaborate closely to ensure that the organization's technology investments align with its financial objectives. This collaboration can lead to better decision-making, increased efficiency, and cost savings.

For example, if the CFO is aware of the organization's technology investments, they can identify opportunities to optimize application costs and prevent SaaS sprawl. Similarly, if the CIO knows the organization's financial goals, they can make data-driven decisions about which applications to retain or replace.

It's a bold move that can transform your company's ability to make wise financial and technological decisions.

Reasons why CIOs & CFOs should collaborate

There are several reasons why collaboration between CIOs and CFOs is important for an organization:

1. Improved decision-making

Decisions made by organizational leaders can make or break a company. Collaboration between the CIO and CFO can significantly improve decision-making, ultimately contributing to the organization's success. The CFO's financial expertise and the CIO's technical knowledge can help create a holistic approach to decision-making.

The collaboration between CIO and CFO can result in improved decision-making in various areas of the organization. One of the key areas where this collaboration can be beneficial is technology investments.

When the CIO and CFO work together, they can determine which technology investments to prioritize, considering both the technical requirements and the financial implications. This can help the organization invest in technologies that provide the most value and align with the organization's overall goals and budget.

Another area where collaboration can be valuable is in identifying areas where the organization can cut costs. The CIO and CFO can analyze the organization's technology spending and determine if there are any redundancies, underutilized resources, or areas where the organization can save money. This information can then be used to make informed decisions about which technologies to retain, consolidate, or eliminate.

Ultimately, by leveraging these two leaders' unique perspectives and expertise, organizations can make strategic decisions that benefit the entire organization.

2. Better alignment of IT and business goals

Imagine a scenario where the IT department wants to invest in the latest and greatest technology, but the CFO hesitates due to the high cost. By collaborating, the CIO and CFO can have an open and honest discussion about the expected return on investment, potential risks, and the impact on the organization as a whole.

This helps to ensure that technology investments are made with a clear understanding of the expected outcomes, benefits, and costs.

Moreover, this alignment between IT and business goals enables companies to stay competitive in their respective industries. For instance, a retail company that invests in innovative e-commerce technologies can improve customer experience, increase sales, and gain a competitive advantage over rivals.

However, if the company invests in technology that doesn't align with the business strategy, it can result in a waste of resources and an unsuccessful outcome.

Collaboration between the CIO and CFO to align IT and business goals can lead to more informed technology investments, improved communication, better resource allocation, and increased competitiveness. This is crucial for the success and growth of any organization in today's technology-driven world.

3. Increased efficiency and cost savings

By identifying opportunities for automation, streamlining, and reducing duplication, companies can optimize their resources and reduce costs while maintaining or increasing efficiency. For example, implementing a CRM system can automate sales and marketing processes, reducing the need for manual labor and potentially increasing sales.

Similarly, robotic process automation (RPA) can help automate repetitive tasks, such as data entry, resulting in cost savings and improved accuracy.

Collaboration between the CIO and CFO can also lead to a reduction in duplication of effort. By working together, they can identify areas of overlap and consolidate efforts, leading to increased efficiency and cost savings.

Furthermore, by understanding the costs and benefits of technology investments, the CFO can make informed decisions about resource allocation. This results in more efficient use of resources and cost savings for the organization.

4. Enhanced risk management & security

Cyber threats and other security risks are a constant concern for organizations. A single data breach or cyber attack can result in significant financial losses, damage to reputation, and loss of customer trust. That's why it's important for the CIO and CFO to work together to ensure that the organization is adequately protected.

By collaborating, the CIO and CFO can ensure that the organization has the financial and technical resources to manage security risks. For instance, the CFO can provide financial resources to support security initiatives, such as implementing multi-factor authentication, upgrading firewalls, and conducting regular vulnerability assessments.

On the other hand, the CIO can implement technical solutions to address those risks, such as encryption, data backup, and disaster recovery plans.

Moreover, the CIO and CFO can work together to identify and prioritize security risks based on their potential impact on the organization. By understanding the financial implications of a security breach, the CFO can make informed decisions about resource allocation for security initiatives.

Similarly, the CIO can provide technical expertise to identify and mitigate security risks.

In addition to protecting against cyber threats, the collaboration between the CIO and CFO can also lead to enhanced risk management in other areas of the organization. For example, the CFO can work with the CIO to implement systems that monitor and control access to sensitive financial data, reducing the risk of fraud or misuse.

5. Increased budget transparency

Increased IT budget transparency is important to effective IT and business alignment. When the CIO and CFO work together, they can ensure that the organization's IT budget is transparent, providing clear visibility into how funds are allocated and spent.

Transparency can help to build trust between the IT department and other parts of the organization. It enables stakeholders to understand IT investments' value and identify areas where resources can be optimized or reallocated.

Collaboration between the CIO and CFO can also help to prioritize IT investments based on business goals and expected returns on investment. By working together, they can ensure that the IT budget is aligned with the organization's overall strategy and that investments are made in areas with the greatest potential to contribute to business growth and success.

In addition to this, increased IT budget transparency can help to identify inefficiencies and cost savings opportunities. The organization can optimize its IT budget by analyzing spending patterns and identifying areas where resources are being underutilized, reducing costs and improving efficiency.

6. Effective resource allocation

Effective resource allocation is critical to any successful IT strategy. When the CIO and CFO collaborate, they can ensure that IT resources are allocated in a way that aligns with the organization's overall business strategy. This ensures that IT investments are used to maximize their potential for contributing to the organization's growth and success.

Collaboration between the CIO and CFO can also help to ensure that IT investments are allocated appropriately. The organization can optimize its IT budget and improve resource allocation by analyzing spending patterns and identifying areas where resources are being underutilized or overutilized. This can result in significant cost savings and improved efficiency.

Moreover, the CIO and CFO collaboration can help prioritize IT investments based on their potential for contributing to business goals. By working together, they can identify areas where IT investments can have the greatest impact, such as improving customer experience, increasing productivity, or enhancing security. This helps ensure that IT investments are made in areas with the greatest potential for contributing to the organization's overall success.

In addition, the CIO and CFO collaboration can help identify areas where IT resources can be shared or consolidated. The organization can optimize its IT resources by identifying redundancies and areas where resources are being underutilized, reducing costs, and improving efficiency.

Streamlining CIO-CFO Collaboration with Zluri

If you're a CIO or CFO, you know that collaboration is key to success. But what if there was a tool that could take your collaboration to the next level?

What if we tell you that there's a tool that can help CIOs and CFOs work together in harmony, like Batman and Robin? Yes, you heard it right! Zluri is a SaaS management platform that can streamline CIO-CFO collaboration and make it more productive than ever before.

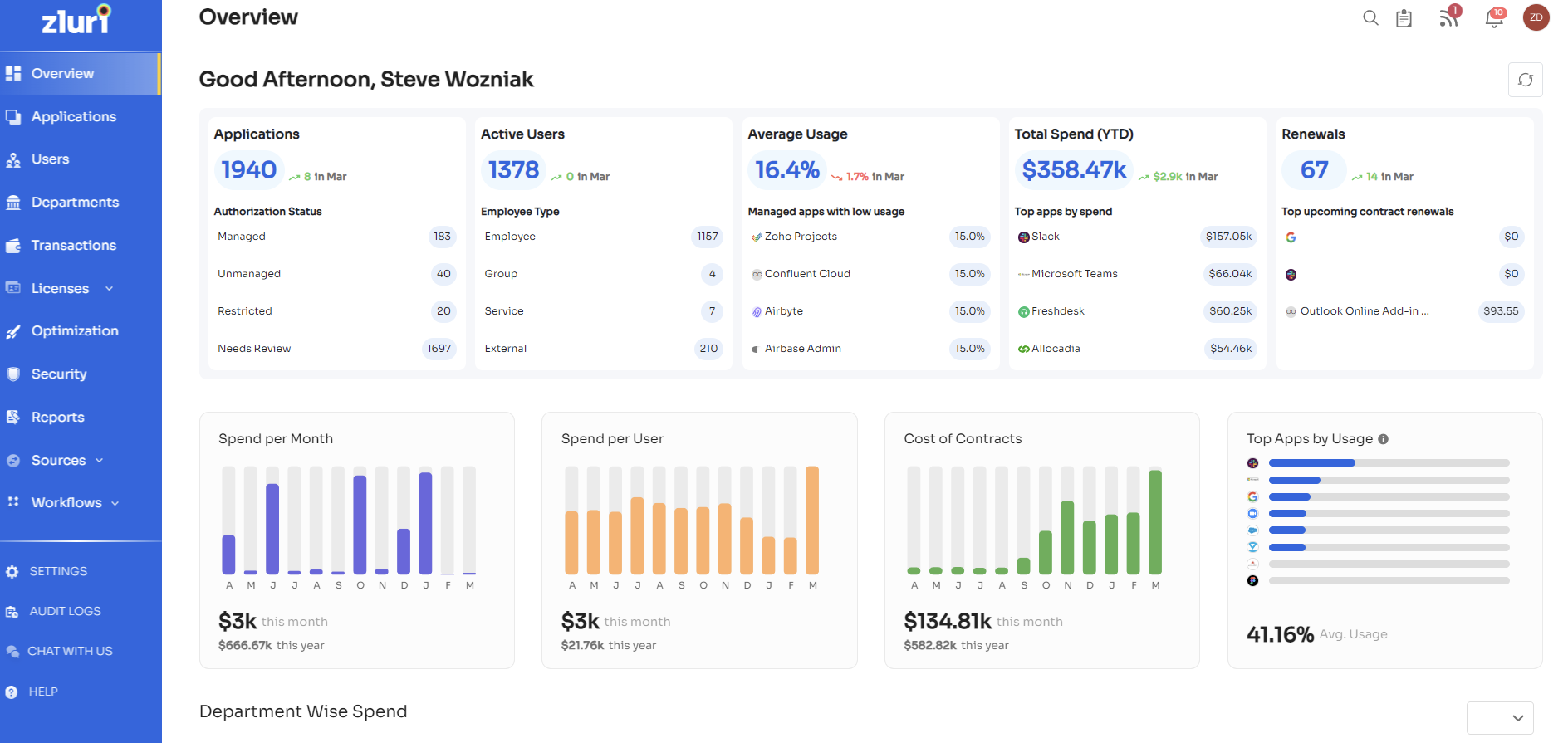

Zluri helps streamline collaboration and provides real-time insights into an organization's SaaS spend, usage, and compliance. One of Zluri's key features is its comprehensive dashboard that provides a complete overview of all SaaS applications used within the organization.

It identifies applications that are underutilized, redundant, or non-compliant, enabling CFOs to understand the total cost of ownership of the organization's SaaS stack. This information also helps identify opportunities to optimize application costs and prevent SaaS sprawl.

Zluri's analytics are particularly helpful for CIOs, as they can identify patterns in employee usage and adoption of SaaS applications. This data-driven decision-making enables CIOs to retain or replace applications effectively, ensuring that the organization only pays for applications that are being used effectively.

This can help optimize cost and ensure that the organization's SaaS applications align with its goals and objectives.

Furthermore, Zluri's role-based access control and approval workflows ensure that procuring new SaaS applications aligns with the organization's budget and compliance policies. This collaborative workflow helps keep both CIO and CFO informed and in the loop about new purchases, including the expected costs and potential savings.

Zluri's reporting and analytics can help both CIOs and CFOs collaborate on future SaaS strategies. The platform provides detailed insights into SaaS usage and spend, allowing them to make informed decisions about which applications to retain, replace, or consolidate. This information helps inform discussions around the organization's technology roadmap, ensuring the SaaS applications align with its long-term goals.

Look at what a fellow CFO had to say about us!

With Zluri, organizations can make data-driven decisions, achieve goals efficiently, and stay ahead of the competition. So what are you waiting for? Book a demo with us today!

Related Blogs

See More

Subscribe to our Newsletter

Get updates in your inbox